Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

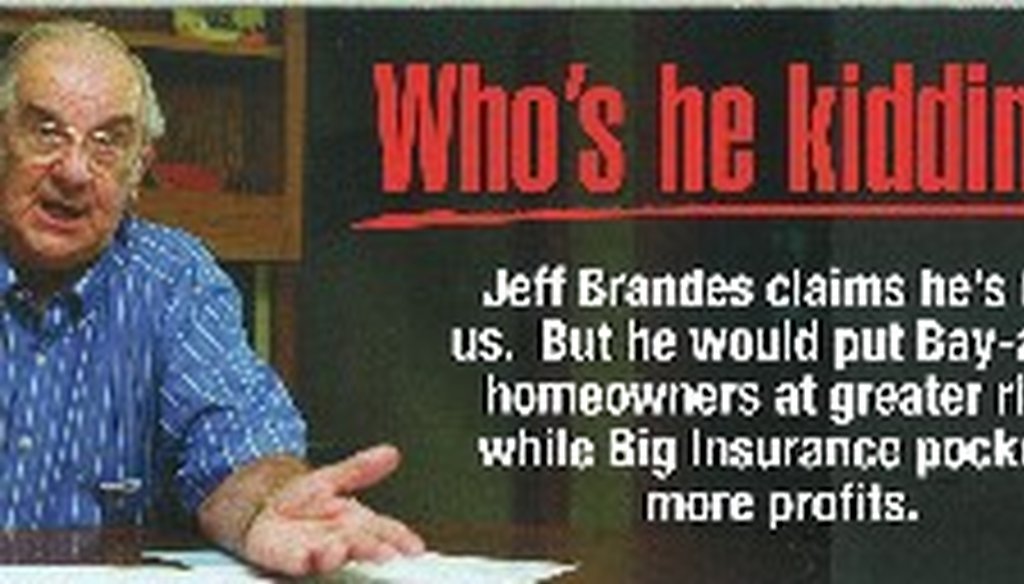

A third-party group is targeting St. Petersburg Rep. Jeff Brandes.

Two sitting state House members, Jeff Brandes and Jim Frishe, are duking it out for the Republican nomination in state Senate District 22.

And both men have third-party groups coming to their aid.

The group Committee to Protect Florida claims in a new mailer that Brandes voted in the House to allow state-run Citizens Property Insurance to dump policies onto "out-of-state, unregulated private companies."

Accountability in Government counters in a TV ad that Frishe wanted to "tax us for doing our taxes" through an accountant.

PolitiFact Florida decided to check out both claims ahead of the Aug. 14 primary. (District 22 covers southern Pinellas County and parts of Hillsborough County including South Tampa, East Tampa and Seminole Heights.)

We’ll start with the claim attacking Brandes, which centers on one of the diciest issues of the 2012 legislative session.

The measure (HB 245) would have allowed "surplus lines" companies to take over Citizens policies in an effort to shrink the company. These companies, which Democrats likened to vultures, are not overseen by the state Office of Insurance Regulation and usually have higher premiums.

Many Republicans, including Gov. Rick Scott, say Citizens would be overexposed should a calamitous storm hit the state. Put simply, Scott and others say that Citizens does not have the ability to pay out claims in the event of the storm, which would leave the state in a disastrous position. So they think it’s better to move policyholders to other, more stable companies, they say, even if it means higher premiums.

Supporters of the bill pointed to a few consumer-minded safeguards, such as requiring companies to have at least $50 million in surplus and the financial strength to withstand two hurricanes. Opponents said homeowners would be out of luck should such a company became insolvent, though, because it would not be covered by the Florida Insurance Guaranty Association.

The version that passed a full vote of the House on Feb. 3 would have automatically moved policyholders to a surplus lines company if they did not opt out within 30 days notice.

The House approved the measure 66-48. Brandes voted Yes.

But that’s not the entire story.

When the Senate later considered the proposal, it altered the bill to be more consumer-friendly. The Senate made the measure "opt-in," meaning a consumer had to proactively approve the switch with a signature.

Supporters of the original proposal argued that the change would gut the intent of the bill: to reduce the number of policies held by Citizens. And when the amended bill bounced back to the House, Republican members proposed to reject the opt-in provision and kick the bill back to the Senate.

But that idea failed in the closest House vote of the session.

This time Brandes essentially switched sides, voting against blocking the Senate’s opt-in amendment (put another way, in favor of the opt-in requirement.)

The sponsor of the original bill then killed the proposal, since it had an opt-in requirement. On balance, we rated Brandes’ claim Mostly True.

The claim against Frishe, meanwhile, goes all the way back to 1987, when Frishe was serving his first stint in the state House.

The plan to tax accountant services was part of a much broader proposal to create a sales tax on services.

The idea was to broaden the state’s tax base, Frishe explained. There was no recession that year; rather, Florida’s economy was booming. Still, the state needed money to fix roads and pay for an influx of new public school students.

To do that, the Legislature passed a 5 percent sales tax on many personal and professional services, including accountants’ fees, agricultural services, house-building, architect and engineering fees, pest control, cleaning services, computer and data processing, advertising, legal fees, magazine and newspaper subscriptions and newspaper rack sales, pet-grooming and cleaning services.

Frishe voted in favor of creating the tax in April 1987.

The plan quickly backfired, however, amid public uproar. The services tax was repealed in December 1987 and replaced with a 1 percent increase in the sales tax on goods — from 5 percent to 6 percent.

Frishe voted against the repeal — though he said he supported the repeal — because it included the increase in the sales tax on goods.

While those caveats give a fuller picture of Frishe’s position and his vote, they do not undermine the statement made by the group Accountability in Government. We rated the claim True.

Our Sources

See individual fact-checks for complete sources.