Get PolitiFact in your inbox.

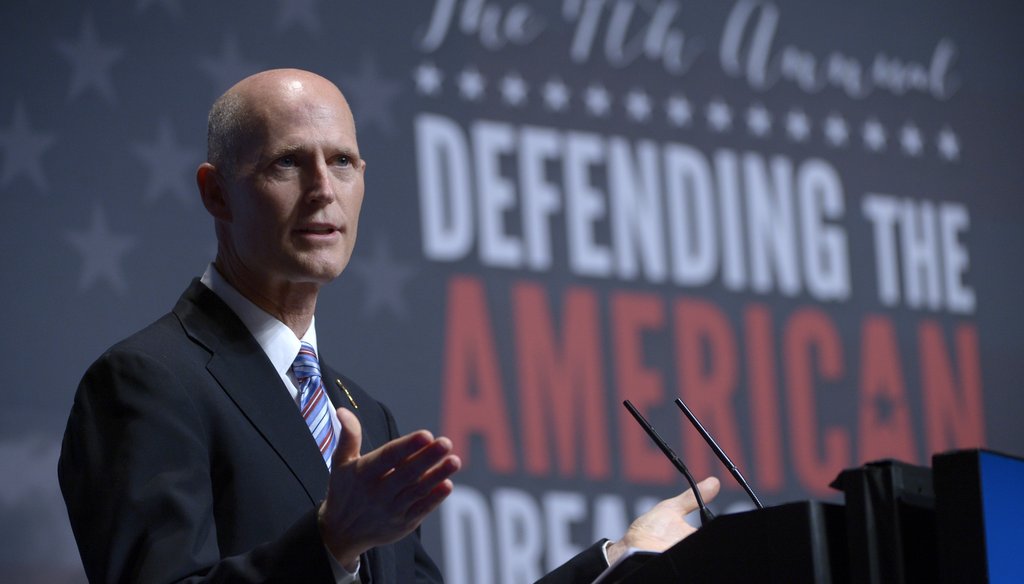

Gov. Rick Scott speaks at the Americans for Prosperity Foundation's Defending the Dream Summit on Aug. 30. Photo by Associated Press.

Gov. Rick Scott is proud of cutting taxes, and he’s not afraid to show it. But are the cuts and other moves from the conservative playbook responsible for Florida’s improved economy, as Scott recently claimed?

Speaking at an Americans for Prosperity Foundation summit, Scott pointed to the resurgence in general revenue -- expected to reach a record-high in 2014-15 -- as a sign his policies are working.

"After right-sizing government and cutting taxes, this year we had our first budget surplus in six years," he said on Aug. 30, 2013. "It gets better: Our state revenue estimating conference says we will have the highest general revenue in state history next year. Conservative pro-growth policies work in our state."

We rated the claim linking record revenues with Scott’s policies as Mostly False. Scott failed to account for inflation when making his record revenue claim, and he overstepped by linking the revenue to his policies. An array of experts pointed out that it’s a trend felt by most states, including several run by Democrats.

Scott pared down his talking point that he cut taxes 24 times, boasting instead of cutting them five times.

"We cut property taxes for homeowners and businesses. We cut business taxes so today 70 percent of our businesses don't pay a business tax. And we got rid of a sales tax on machinery and equipment so we will have more manufacturing jobs."

We wondered if 70 percent of businesses really don’t pay a business tax. Scott promised to eliminate this tax, but he’s settled for a strategy that involves gradually removing businesses from having to pay it. Actually, the number of exempt businesses is 76.8 percent, according to 2011 state data, though Scott includes very small businesses and many of them were already not subject to this tax before he took office. We rated his claim Mostly True.

Our Sources

See individual fact-checks.