Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

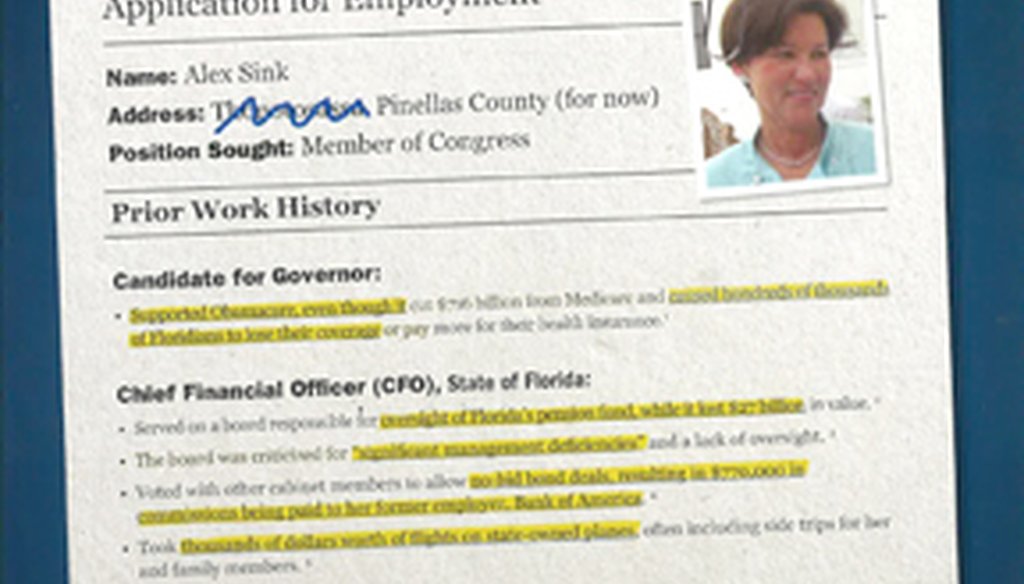

The Republican Party of Florida mailer, designed to look like a job application, uses most of the GOP's attacks on Alex Sink during the campaign.

Thanks to Alex Sink’s years as a banking executive in Florida, plus her statewide campaigns for higher office, Republicans have had years to hone attacks against her in the race for Pinellas County’s open U.S. House seat.

In a mailer, the Republican Party of Florida lists a raft of attacks about Sink’s past they have used over and over.

The mailer is designed to resemble a job application, as Sink is asking Pinellas County voters to hire her as their congressional representative. The flier uses her "prior work history" to make attacks on her.

PolitiFact Florida has issued ratings on many of the claims and found some are more accurate than others.

As CFO

The faux application makes mention of her known support of Obamacare then moves on to "Chief Financial Officer (CFO), State of Florida," Sink’s time in the office between 2007 and 2011. It first lists "served on a board responsible for oversight of Florida’s pension fund, while it lost $27 billion in value."

Sign up for PolitiFact texts

The mailer is referring to her duty as CFO to serve on the State Board Administration of Florida, the office that oversees the state pension fund.

The pension fund saw a net drop in the fund’s assets from $136.3 billion in 2007 to $109.3 billion in 2010. Those assets have since rebounded to about $132 billion in 2013, however, because the fluctuation occurred in the midst of the Great Recession and weren’t permanent losses. Also, former Gov. Charlie Crist and former Attorney General Bill McCollum, both Republicans, were also board trustees. We rated the claim of Sink being responsible for losses as Half True.

Next, the flier says Sink "voted with other Cabinet members to allow no-bid bond deals, resulting in $770,000 in commissions being paid to her former employer, Bank of America." Rick Scott brought this up during the 2010 campaign, accusing her in a TV commercial of having "funneled three quarters of a million dollars" to the bank.

In 2009, the Times found that Sink voted with Gov. Crist and fellow Cabinet members to allow negotiated, or no-bid, bond deals for a financial underwriting team that included her former employer, Bank of America. One transaction resulted in $770,000 in fees for the bank and its newly acquired Merrill Lynch unit. But Sink would have had no way of knowing the bank’s role among the 12 members of the underwriting team when it was created, or subsequent commissions any member would potentially earn. She also didn’t negotiate the details of the deal when it was approved. PolitiFact Florida rated this claim Mostly False.

The GOP also says Sink "took thousands of dollars worth of flights on state-owned planes, often including side trips for her and family members."

Sink spent $413,334 on air travel between January 2007 and June 22, 2009, using two state airplanes, which led to an ethics complaint filed against her and other Cabinet officials for abusing state resources. The subsequent investigation noted that she did take family members on trips occasionally, but that it was common practice among officials at the time. The investigation also found that statutes were so inconsistent there was no way to determine wrongdoing.

Bank of America

In "President, Bank of America & NationsBank," the state Republican Party takes aim at Sink’s years as a banking executive overseeing Florida operations between 1993 and 2000. The mailer claims she "made $8.8 million in three years, even though she eliminated thousands of Florida jobs."

The income number matched her tax returns for 1999-2001. The job losses came from a 1997 acquisition of Barnett Bank by her employer NationsBank, and a 1998 merger with Bank of America (NationsBank took the BoA name afterward).

The number of positions lost were estimated at 6,000 from the Barnett purchase and 8,000 from the Bank of America merger, but actual figures were never published. Considering mergers and acquisitions often result in job losses, the estimate sounded reasonable. In 2010, we rated the statement that she eliminated jobs while getting a high salary as Mostly True.

The flier also says "her bank was fined for 'deceptive and misleading’ investment advice to elderly customers." This was a reference to a 1994 scandal at NationsBank and its NationsSecurities subsidiary in which a broker named David Cray blew the whistle on improper sales methods.

The subsequent investigation found the bank had in fact been targeting elderly customers, among others, by moving them from federally insured checking accounts into risky investment accounts, but not notifying them of the risk. The bank was fined millions by the federal government and the SEC between 1998 and 2002, and settled a class-action lawsuit from investors.

During a 2010 debate, Scott pointed out she was Florida president of the bank at the time. Sink responded that the lawyer in the case against NationsBank "has said publicly that Alex Sink had nothing to do with the case, had nothing to do with the situation and didn’t know about the problems," a statement we ruled Mostly True. Both the lawyer in the case, Jonathan Alpert, and whistleblower Cray said she was not the target of their lawsuits.

The final item on the case against Sink is that "a subsidiary was accused of predatory lending that targeted minority communities, the elderly and women during Sink’s time as bank president." It repeats a recent attack ad that claimed she had "failed Florida homeowners by using predatory lending practices."

This attack turns on her bank’s merger with Barnett, which owned a subprime lending unit called Equicredit. The subsidiary was singled out in congressional testimony for predatory lending in 2000 and was eventually sold off, but was operated by NationsBank’s national headquarters and did not answer to Sink. We rated the claim that Sink herself engaged in predatory lending as False.

Our Sources

See indivdual fact checks for complete source list.