Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

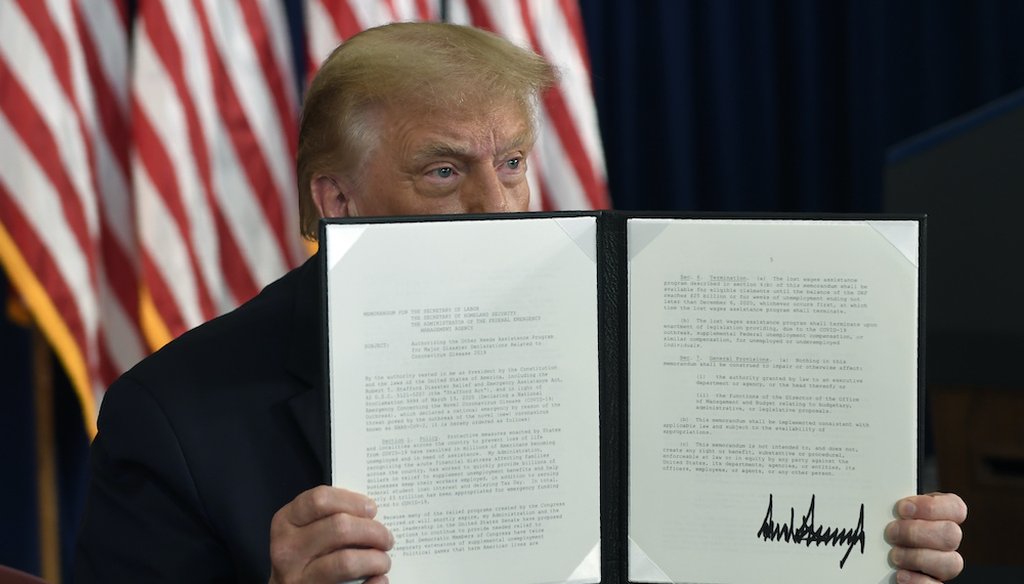

President Donald Trump signs an executive order during a news conference at the Trump National Golf Club in Bedminster, N.J. (AP Photo/Susan Walsh)

If Your Time is short

-

Donald Trump’s payroll tax holiday would give the median worker an extra $75 each week.

-

There are many unanswered questions, such as whether workers would need to pay the money back, and whether companies will decide to participate.

-

This executive action by itself doesn’t cripple either Social Security or Medicare, but it does increase the pressure on huge programs already under financial stress.

President Donald Trump’s weekend order to give millions of workers a break on payroll taxes caught many people by surprise, and created a range of reactions, criticism and questions.

Each paycheck, employees see 6.2% of their wages go to Washington to help fund Social Security. Trump ordered Treasury Secretary Steve Mnuchin to defer those payments for at least four months, from September through the end of the year.

That means someone making the median weekly wage of about $1,000 could see an extra $62 in their paycheck. (We say "could" because the memo says employers don’t need to send the money to Washington. It doesn’t say they must give it to their workers, and there’s a debate in the business community over what to do.)

Trump’s order applies to people making up to $2,000 per week, so people who earn $104,000 a year or higher wouldn’t get the tax break.

After those basics, things get more complicated.

Sign up for PolitiFact texts

As written, Trump’s order provides temporary relief. At some point, the missed payments would need to be made up, but the memo says the administration will look for a way to let people keep the money.

Mnuchin told Fox News Sunday that the money would be made up for with dollars from the general fund. The administration can’t promise that on its own. Congress, which controls federal spending, would need to pass a bill to make it happen.

Employers already are getting a tax holiday. They match the employee contribution, and under the last COVID-19 relief package, the CARES Act, their payments are on hold until the end of the year. They have two years to pay it back. They need to send Washington half by the end of 2021 and the other half by the end of 2022.

Social Security and Medicare amount to over a third of all federal spending, and the payroll tax delivers nearly 90% of the money to keep them running. As more people retire, there’s less money to keep them solvent. Less money coming into the system only exacerbates the problem.

The executive order has already fueled chatter on social media about what it means for the future of Social Security. We looked at four different Facebook posts.

Editor's note, Aug. 12, 2020: This story has been corrected to clarify that the payroll tax holiday affected only the Social Security portion of the payroll tax and that the median worker would see savings of $62.

Our Sources

White House, Memorandum on Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster, Aug. 8, 2020

White House, Remarks by President Trump in Press Briefing, Aug. 8, 2020

Fox News, Fox News Sunday, Aug. 9, 2020

CNN, State of the Union, Aug. 9, 2020

Jenna Ellis, tweet, Aug. 8, 2020

Congressional Budget Office, The federal budget in 2019, April 2020

Social Security Administration, 2020 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, April 22, 2020

U.S. Bureau of Labor Statistics, USUAL WEEKLY EARNINGS OF WAGE AND SALARY WORKERS, July 17, 2020

Internal Revenue Service, Deferral of employment tax deposits and payments through December 31, 2020, July 30, 2020

Inc., Why Businesses Should Ignore Trump's Payroll Tax Holiday, Aug. 9, 2020

Forbes, White House Walks Back ‘Permanent’ Payroll Tax Cut Amid Social Security Concerns, Aug. 9, 2020

Bloomberg, Trump’s Payroll Tax Action Creates Political, Business Risks, Aug. 9, 2020

Kiplinger, What Trump's Payroll Tax Cut Will Mean for You, Aug. 10, 2020

Email exchange, William Hoagland, senior vice president, Bipartisan Policy Center, Aug. 10, 2020

Email exchange, Eugene Steuerle, economist and cofounder, Urban-Brookings Tax Policy Center., Aug. 10, 2020