Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

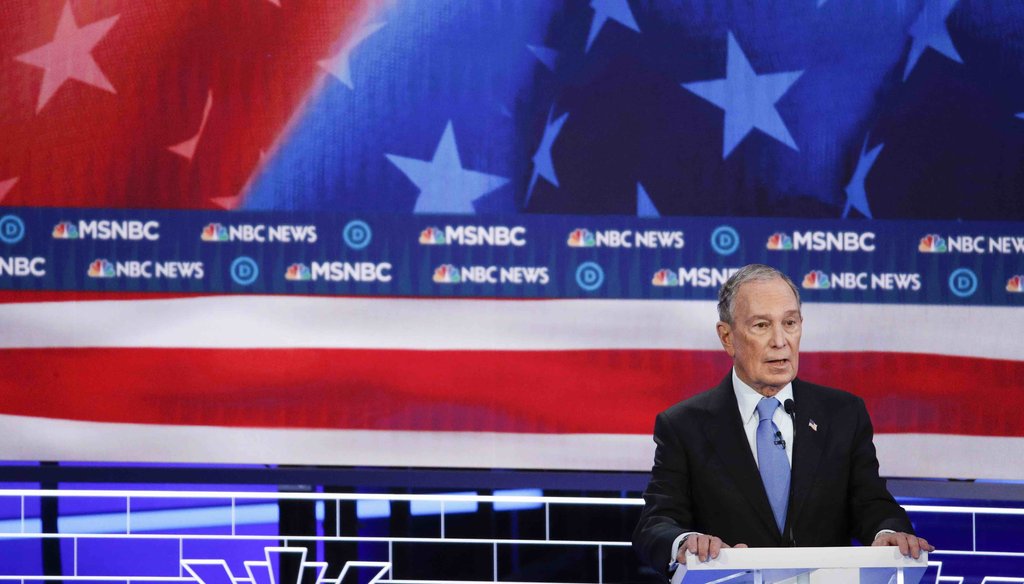

Democratic presidential candidates, former New York City Mayor Mike Bloomberg speaks during a Democratic presidential primary debate on Feb. 19, 2020, in Las Vegas, hosted by NBC News and MSNBC. (AP)

If Your Time is short

-

Mike Bloomberg said his 2008 comments about redlining were misunderstood and that he has never supported the practice.

-

As evidence, his campaign pointed to efforts he took as New York mayor to prevent predatory lending and mortgage foreclosures.

-

Redlining as a banking practice was outlawed in the 1970s. Predatory lending is a related but slightly different phenomenon.

-

Bloomberg did offer assistance to homeowners, but he also opposed new banking regulations that he considered excessive.

Under attack for his past statements about redlining and the financial crisis, former New York Mayor Mike Bloomberg said he has been a longtime critic of discriminatory lending.

During the Feb. 19 debate in Las Vegas, NBC’s Chuck Todd asked Bloomberg to explain comments he made in September 2008 about redlining. Bloomberg suggested that the end of redlining encouraged excessive lending, which led to a mortgage crisis and then a financial crisis. (Redlining is a discriminatory practice that involves drawing lines around certain neighborhoods to exclude creditworthy applicants, often African Americans, from obtaining loans.)

Here’s their exchange:

Todd: "Mayor Bloomberg, you seemed to imply that redlining and stopping redlining has somehow contributed to the financial crisis."

Bloomberg: "No, that's exactly wrong. ... I've been well on the record against redlining since I worked on Wall Street. I was against it during the financial crisis. I've been against it since. The financial crisis came about because the people that took the mortgages, packaged them, and other people bought them, that's where all the disaster was. Redlining is still a practice in some places, and we've got to cut it out. But it's just not true."

Sign up for PolitiFact texts

We found no direct statements in which Bloomberg explicitly said he opposed redlining. But his campaign’s argument is that after redlining was banned in the 1970s, predatory lending followed. As New York mayor, Bloomberg supported initiatives to combat predatory lending.

Here, we’ll look at the issue and at Bloomberg’s record as mayor. Bloomberg did offer assistance to homeowners, but he also opposed new banking regulations that he considered excessive.

In his current campaign, Bloomberg supports helping African American homeowners and has vowed to fight for fair lending.

RELATED FACT-CHECK: Mike Bloomberg’s redlining remarks distorted by Elizabeth Warren

Redlining goes back decades and was encouraged by government policies, according to Richard Rothstein, author of the book "The Color of Law."

The Federal Housing Administration, created in 1934, refused to insure mortgages in African American neighborhoods. Neighborhoods with minorities were marked in red on maps. Meanwhile, the FHA subsidized building in the suburbs for white people.

"A neighborhood earned a red color if African Americans lived in it, even if it was a solid middle-class neighborhood of single-family homes," Rothstein wrote.

The Community Reinvestment Act banned redlining in 1977. What followed was deregulation that paved the way for predatory lending, said Nikitra Bailey, a housing expert at the Center for Responsible Lending.

By the late 1990s, unregulated finance companies were targeting black communities with aggressive marketing of loans that were unaffordable or had confusing terms.

"The very same communities that were redlined were the same communities overpopulated with subprime loans," she said.

Nationwide, cities — including New York and states undertook efforts to combat predatory lending and foreclosures.

Bloomberg’s campaign pointed to initiatives the city undertook during his tenure as mayor, before and after the financial crisis, to prevent predatory lending and foreclosures:

-

In 2005, the city announced a $1.35 million "Preserve Assets and Community Equity" program that included outreach, education and financial assistance. It was aimed at homeowners, groups and neighborhoods historically targeted by predatory lenders.

-

In 2007, Bloomberg announced the Center for NYC Neighborhoods to assist homeowners at risk of foreclosure through legal assistance and loan remediation. The center had a projected first-year budget of $5.3 million.

-

The city provided rental assistance to seniors.

But Bloomberg also opposed the New York City Council’s efforts to do more. In October 2002, he vetoed a bill to ban financial institutions that engaged in predatory lending from doing business with the city. A spokesman for Bloomberg at the time said the measure was ''not the appropriate vehicle for addressing these concerns.'' The City Council overrode his veto.

Bloomberg then took the City Council to court, arguing that it lacked the authority to decide what businesses could do work with the city. A judge struck the law down, ruling that it was preempted by state law.

James Sanders Jr, a councilman from New York’s Queens borough at the time, told PolitiFact that Bloomberg’s programs were inadequate to help those who needed the most help, including people of color.

"He opposed common-sense legislation that would have protected many of these people," Sanders, now a state senator, told PolitiFact. (Sanders is supporting Sen. Bernie Sanders for president but is not related.)

In 2012, Bloomberg vetoed the City Council’s Responsible Banking Act, which was intended to get banks the city worked with to reinvest in low-income neighborhoods. The act called for banks to disclose certain activities at their branches, including loans granted.

''You would think, between the federal government and the state government, we'd have enough bank regulations,'' Bloomberg said in 2012 when the bill was proposed. ''I don't know why the City Council thinks that they have the expertise, or can really add anything other than just adding costs to banks to try to comply.''

The City Council overrode Bloomberg’s veto. The New York Bankers Association sued, and a federal judge ruled the law unconstitutional in 2015, saying it conflicted with federal and state laws.

Our Sources

City Lab, How the Fair Housing Act Failed Black Homeowners, April 11, 2018

Governing, Federal Housing Discrimination Still Hurts Home Values in Black Neighborhoods, April 30, 2018

Politico, City moves to implement bank law blocked by Bloomberg, Jan. 12, 2015

Queens Chronicle, City Council Vows To Fight For Recently Invalidated Lending Law, Feb. 12, 2004

NewsDay, A Struggle For Loan Protection, March 7, 2003

NewsDay, Lending Law Appeal Likely, Jan. 28, 2004

The IndyPendent, Subprime Mike: How Mayor Bloomberg fought efforts to protect black homeowners from predatory lenders, Feb. 12, 2020

Securities Week, NYC predatory loan loan opposed as unfair to securities companies, Oct. 7, 2002

AP, Pataki signs bill to do away with 'predatory' lending, Oct. 3, 2002

NewsDay, Mayor Vetoes Bill Restricting Predatory Lenders, Oct. 24, 2012

New York Times, New curbs on predatory loans, Nov. 10, 2002

New York Times, Council Wants Banks Seeking City Deposits to Report on Efforts to Aid Poor Areas, May 15, 2012

New York Times, As Bloomberg’s New York Prospered, Inequality Flourished Too, Nov. 9, 2019

CNBC, NYC’s ‘responsible banking’ law ruled unconstitutional, Aug. 10, 2015

Atlanta Journal-Constitution, The Color of Money, 1989

Telephone interview, Nikitra Bailey, Center for Responsible Lending executive vice president, February 2020

Email interview, Stu Loeser, Mike Bloomberg campaign spokesman, Feb. 19, 2020

Telephone interview, New York State Sen. James Sanders, Feb. 24, 2020