Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

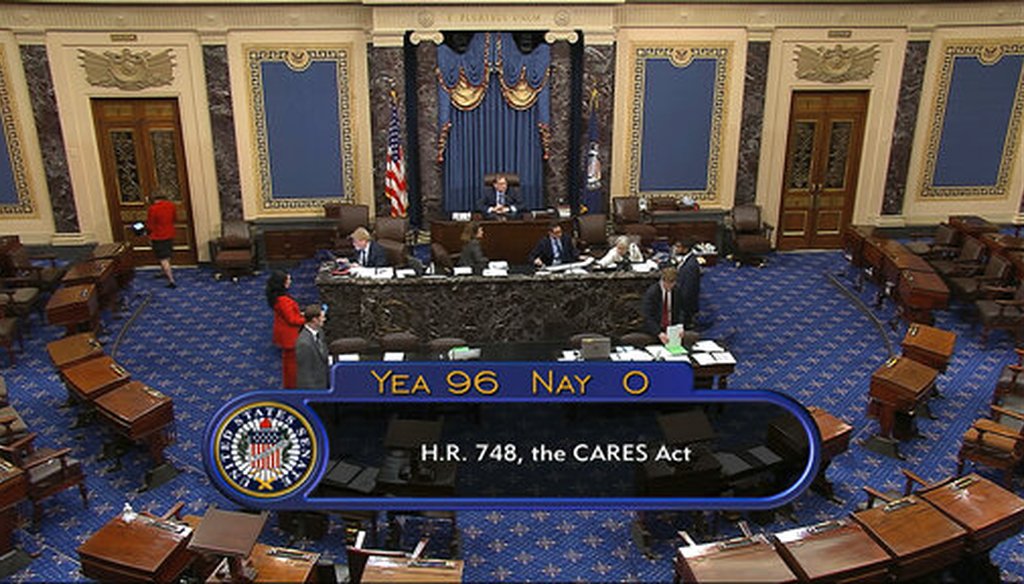

The final vote of 96-0 shows passage of the $2.2 trillion economic rescue package in response to coronavirus pandemic on March 25, 2020. (Senate Television via AP)

If Your Time is short

• The Senate bill sends checks (or direct deposits) of $1,200 per individual and $500 per child. These start phasing out for individuals earning $75,000 and families earning $150,000.

• If you recently lost your job, you’ll be able to get $600 a week on top of your state’s unemployment insurance payments. Struggling gig workers will be able to get the same benefits as conventional employees.

• Small businesses can secure federally guaranteed loans. As long as the proceeds are used to pay employees and expenses like mortgages and utilities, the loans will be forgiven once the economy improves.

The coronavirus relief bill that unanimously passed the Senate on March 26 checks in at 880 pages and more than $2 trillion in expenditures. The bill — which will require the House’s approval and President Donald Trump’s signature before it becomes law — addresses everything from support for the airline industry to support for stressed hospitals.

But the sections of the bill that are of most interest to ordinary Americans are those that involve direct payments from the government. These payments are designed to keep the economy moving and prevent households from falling into an economic chasm. They include a mix of checks, enhanced unemployment insurance payments, and small business loans designed to keep companies from shedding workers.

Here, we’ll take a look at those portions of the bill.

Will I get a check?

Unless you earn more than the income cap, you should be getting a check.

The federal government will be cutting checks for $1,200 per adult and $500 per child under age 17 as long as you don’t have income exceeding $75,000 per individual or $150,000 per couple. So a family of four would get $3,400.

Sign up for PolitiFact texts

Above those income cutoffs, you’ll still get a check, but it will phase out by $5 for every $100 in additional income. The cost of this provision to the government is estimated to be $290 billion.

How will the Internal Revenue Service determine my family’s amount?

For households that have filed tax returns for 2019 — the ones originally due this coming April 15, but now pushed back to July 15 due to coronavirus — the IRS will calculate your adjusted gross income based on what you reported in 2019. If you haven’t filed a return yet, it will calculate it based on the return you filed for 2018.

For taxpayers in either of these categories, the IRS will deposit your money directly in whatever account you used for previous refunds. If you haven’t used direct deposit, it will send it to your last recorded address. (If your address has changed, you will need to tell the IRS.)

What if I didn’t file a return those years because I didn’t earn enough to owe taxes?

You will get a check, though the process may be a bit more complicated. The IRS may use addresses obtained from other federal agencies, such as the Social Security Administration, to find you.

It’s possible that if you earned too little to file a return and don’t receive any federal benefits — but you would otherwise qualify for a check — then you may have to file paperwork to the IRS. Those details remain to be worked out.

How long will I have to wait?

Nothing can happen until the bill is signed by the president. From there, it could take days to a few weeks for the easiest payments to be made — those for taxpayers who filed returns and who have electronic deposit accounts on file.

If you’re in one of the categories of people who require more work to determine income figures and addresses, it will take longer. It’s too soon to say how long.

I have kids, but I earn more than the income cap for families. Will I get a check for my kids?

No.

I am an undocumented immigrant but I file my taxes every year with an ITIN. Do I get a check?

Experts believe that you won’t.

I got laid off. What does the bill do for me?

The thing to do if you’re laid off is to file with your state for unemployment. That remains a crucial part of getting benefits from the Senate bill, which has allocated $260 billion for this purpose.

The federal government will add to your state-based unemployment payment by $600 a week, or the equivalent of more than $30,000 a year. Combined with the state payment, that’s a significant income replacement, though the current bill only provides this for four months. That time limit could be revisited in a future bill.

The bill also incentivizes states to waive waiting periods for receiving benefits, and provides funds for states to lengthen the time limits for receiving their unemployment benefits by 13 weeks.

If you were already receiving unemployment payments prior to March, you may be out of luck for receiving the enhanced benefits enacted under this bill. That will remain a question for states.

My company considers me to be furloughed, rather than laid off. Will I qualify for these expanded unemployment benefits?

The bill seeks to broaden the definition of "unemployment" to include furloughed workers, so states should begin to count furloughed workers as being unemployed.

I’m a gig worker. What does the bill do for me?

In a landmark move, the Senate bill recognizes that gig workers — from freelancers to Uber drivers — need economic assistance in times like these. So they will qualify for the enhanced unemployment provisions in the new bill. The details about how states will determine the amount of assistance remain to be resolved.

It sounds like I’ll be getting some money back from the government. Will I have to pay taxes on it?

No. Basically, the government is implementing a tax cut for 2020 and giving you an advance on what you would have saved.

Will I have to pay anything back?

In most cases, no. Most of the time, the $1,200 checks and the unemployment insurance will not become a new financial liability for you down the road. The only scenario experts say is possible is that if someone is lucky enough to have a big boost in income in 2020, they may face a liability on some of what they received from the government.

I own a small business. Can I get loans or grants, and what do I have to do in return?

The bill steers $377 billion to the small business sector, a combination of loans, grants, and other assistance.

If you’re a small business, you can receive what amounts to grants — bridge loans that will be forgiven as long as the money is used for payroll, rent, mortgage interest, and utilities.

The loans will be made by banks but guaranteed by the federal government. Small businesses usually take out loans to build facilities and infrastructure, so this is an unusual type of loan. Businesses that can adapt to the new conditions, such as restaurants doing takeout orders or retailers selling goods online, can continue those portions of their business to continue generating revenue.

I’m a homeowner. Do I get help on my mortgage?

Federally backed mortgage loans can be paused for two to six months for people suffering an economic reversal, without fees, penalties or added interest.

I have student loans and I’m having trouble making payments. How will the bill help me?

Student loan borrowers won’t be penalized for not paying down their loans, through Sept. 30.

Our Sources

Text of Senate coronavirus relief bill

Committee for a Responsible Federal Budget, "What's in the $2 Trillion Coronavirus Relief Package?" March 25, 2020

NBC News, "Coronavirus checks, direct deposits are coming. Here's everything you need to know," March 26, 2020

CNN, "What's in the $2 trillion coronavirus stimulus bill," March 26, 2020

New York Times, "5 Key Things in the $2 Trillion Coronavirus Stimulus Package," March 25, 2020

Vox.com, "The Senate just passed a $2 trillion coronavirus stimulus package. Here’s what’s in it," March 25, 2020

Interview with Jack Smalligan, senior policy fellow at the Urban Institute, March 26, 2020

Interview with Marc Goldwein, senior vice president at the Committee for a Responsible Federal Budget, March 26, 2020