Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

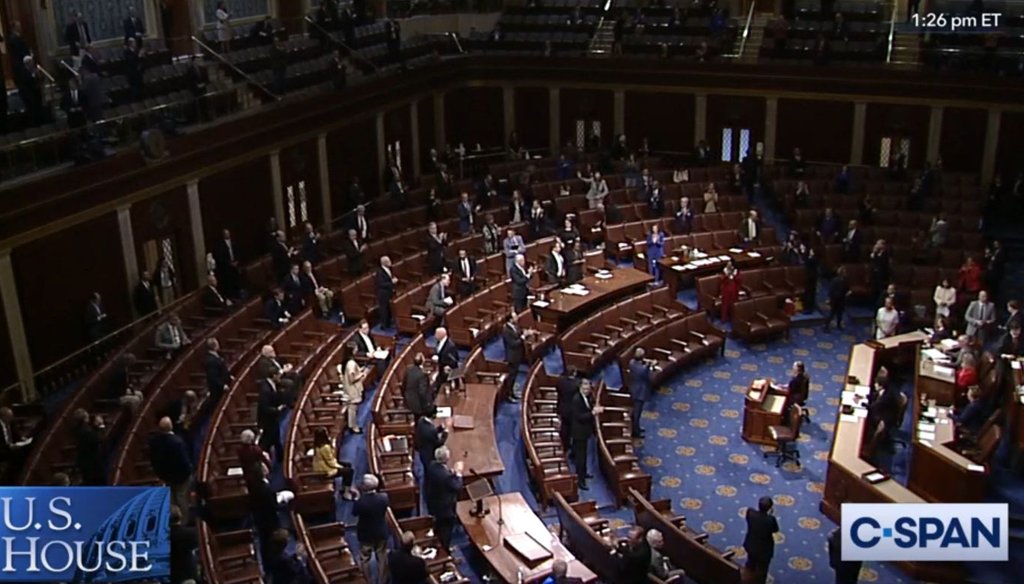

The U.S. House chamber, with members socially distanced, shortly after passage of a $2 trillion-plus coronavirus relief bill on March 27, 2020. (C-SPAN)

If Your Time is short

• The biggest single provision in the bill is a new $454 billion fund charged with making loans to businesses, as well as states and municipalities.

• The bill would provide $180 billion in aid for health care and $42 billion for airlines, airports, and related industries.

• It would also provide $150 billion directly to state, local, and tribal governments.

• The bill seeks to keep corporate recipients of federal assistance on a tighter leash than was the case during the Great Recession, and with greater public transparency.

In a dramatic session in which members social-distanced themselves throughout the House chamber, the U.S. House on March 27 passed the coronavirus relief bill that had already passed the Senate unanimously. The bill, which has a price tag north of $2 trillion, now heads to President Donald Trump for his signature.

Previously, we detailed the provisions that address direct payments to Americans, enhanced unemployment insurance, and assistance to small businesses. Read the story.

Here, we’ll take a look at the bill’s other elements, which address the health care system, big businesses, and state and local governments.

A majority of the $180 billion earmarked for the health care sector will go towards equipment and infrastructure, including protective equipment, testing supplies, training, and new construction. A portion will be spent on Medicare payment increases, medical research efforts, and expansion of the nation’s stockpile of medical equipment for emergencies.

The bill includes $25 billion in loans to commercial airlines, $10 billion for airports, $4 billion for cargo airlines, and $3 billion for aviation contractors. These funds are designed to go toward employee wages, salaries, and benefits for roughly 2 million aviation workers.

Sign up for PolitiFact texts

Airlines will also be temporarily relieved of taxes on tickets, cargo, and fuel, a benefit worth an estimated $4 billion.

The bill creates a new $454 billion fund that is charged with making loans to businesses, as well as states and municipalities. The legislation includes few details on how the recipients will be prioritized and chosen, however. This means the Trump administration could end up having significant discretion.

The bill does specify $17 billion for loans to "firms vital to maintaining national security" (a phrase not elaborated on in the bill) plus $10 billion in loans to the U.S. Postal Service.

Meanwhile, the bill offers $55 billion worth of refundable tax credits for businesses that retain workers on their payroll despite revenue declines. This provision covers up to 50% of the first $10,000 in compensation, including health insurance premiums.

The bill also allows employers to delay paying their share of payroll taxes on their employees for one to two years, a provision estimated to cost $12 billion.

These elements of the bill come on top of assistance to small businesses, which we described in our previous article.

The bill allocates $150 billion in direct aid to help state, local and tribal governments cover rising costs and reduced tax revenues. The payments are scaled to the size of the state, with a $1.25 billion minimum per state. Native American tribes will receive funds from an $8 billion pool.

This $150 billion outlay comes on top of funds falling under the health category above.

Some of the specific budget lines designed to aid state, local, and tribal governments include:

• $45 billion delivered through the Federal Emergency Management Agency’s Disaster Relief Fund, covering such efforts as National Guard deployment, logistics coordination, and safety measures.

• $25 billion for mass transit systems, to protect existing services as well as upgrade health and safety protections.

• $31 billion for K-12 schools and higher education institutions, most of which are scrambling to offer online learning.

• $3.5 billion for child care, focusing on care for the children of health care workers, emergency responders, sanitation workers, and other employees essential to health and public safety.

The bill allocates $42 billion for shoring up the safety net. This includes $25 billion for increased usage of food stamps and child nutrition assistance, which includes aid to schools struggling to provide free lunches off-site. The bill also includes $12 billion for housing support, including homelessness assistance, and $5 billion for child and family services. Food banks will get an additional $450 million.

There is a possibility that the coronavirus pandemic could force states to rely heavily on voting by mail for the general election in November. To address this concern, the bill sets aside $400 million for states to bolster vote-by-mail capabilities, expand early voting and online registration, and bolster the safety of in-person poll workers.

RELATED: Will COVID-19 force a massive absentee vote come November?

After a spate of public concern after the Great Recession, when federal assistance to companies sometimes benefited corporate executives and stockholders, lawmakers included several provisions to keep recipients of federal largesse on a tighter leash.

Companies cannot use federal aid to make stock buybacks or issue dividends. Increases in executive compensation are limited, and collective bargaining agreements cannot be voided.

Details of transactions such as loans and grants to companies will be rapidly made public. In addition, businesses controlled by the president, vice president, members of Congress, and heads of executive departments cannot receive loans or investments from the government.

Finally, the bill establishes both a special inspector general’s office and a congressional oversight commission to conduct oversight.

Our Sources

Text of Senate coronavirus relief bill

Committee for a Responsible Federal Budget, "What's in the $2 Trillion Coronavirus Relief Package?" March 25, 2020

NBC News, "Coronavirus checks, direct deposits are coming. Here's everything you need to know," March 26, 2020

CNN, "What's in the $2 trillion coronavirus stimulus bill," March 26, 2020

New York Times, "5 Key Things in the $2 Trillion Coronavirus Stimulus Package," March 25, 2020

Vox.com, "The Senate just passed a $2 trillion coronavirus stimulus package. Here’s what’s in it," March 25, 2020

NPR, "What's Inside The Senate's $2 Trillion Coronavirus Aid Package," March 26, 2020

Interview with Jack Smalligan, senior policy fellow at the Urban Institute, March 26, 2020

Interview with Marc Goldwein, senior vice president at the Committee for a Responsible Federal Budget, March 26, 2020