Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

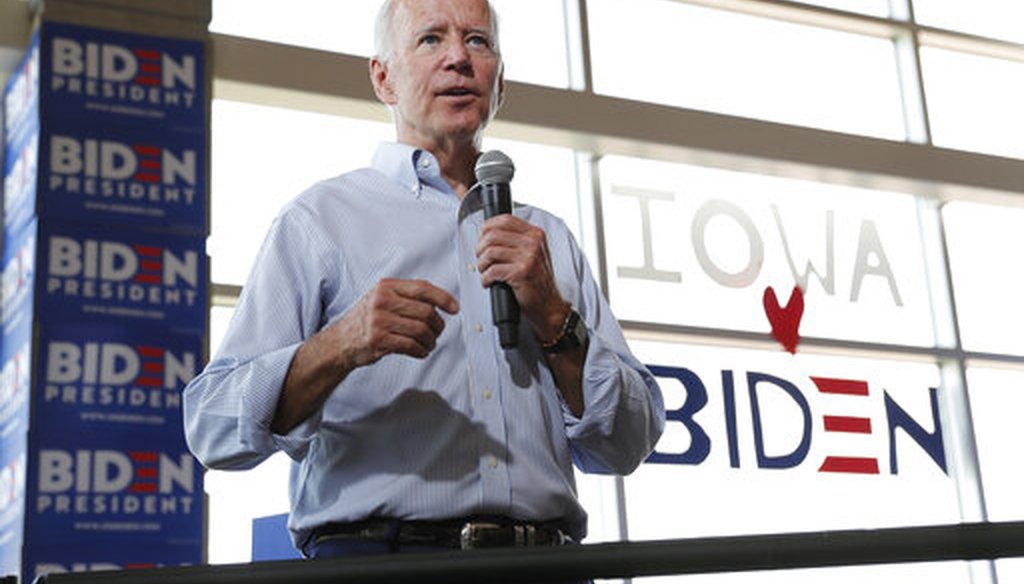

Democratic presidential candidate former Vice President Joe Biden speaks during a town hall meeting, Tuesday, June 11, 2019, in Ottumwa, Iowa. (AP)

Joe Biden says there are tax breaks for racehorses, not child care. That’s misleading

Joe Biden criticized the tax bill signed by President Donald Trump and said it doesn’t do enough to help working families.

"Why should you get a break for racehorses and not get a break for child care?" Biden said in a June 11 speech in Iowa.

Biden’s general point was to question why Congress has pursued tax benefits for the owners of racehorses while not giving tax breaks to parents with hefty child care expenses.

Biden has floated the idea of an $8,000 tax credit for child care to encourage more women to enter the workforce. Biden may want larger tax breaks, but his statement could create the misleading impression that parents don’t get one now, and that’s not the case.

Child tax credit and child care tax credit

The first thing to know about Biden’s statement is that there are two key credits that pertain to families with children: the child tax credit and the child and dependent care tax credit.

The child tax credit is not tied to any expenses such as day care — taxpayers are eligible if they have children under the age of 17.

The 2017 legislation doubled the tax credit for each child from $1,000 to $2,000. However, to get to the last $600, you have to actually owe taxes.

The credit applies to more affluent families than previously, phasing out at $400,000 rather than $110,000 for joint filers. These provisions will sunset after 2025.

How much of a credit it actually translates to varies depending upon income, said Elaine Maag, a researcher at the Tax Policy Center, a joint venture of the Urban Institute and Brookings Institution. For low-income families, they generally get a tax cut of about $75 while higher-income people do a little better.

"For middle-income families many of them did see child tax credits double, but at the same time they lost personal exemptions for their child," Maag said. "They are a little better off but not $1,000 per child better off."

The child care tax credit was not changed by the 2017 bill. Taxpayers who paid money for daycare, after school care or summer camp for a child under age 13 can get part of that money back in the form of a tax credit — but only if they owe taxes. Usually the credit applies to 20% of expenses up to $3,000 for a child.

While the tax bill didn’t change the child care tax credit, it became a little less valuable due to the changes in the child tax credit.

"Unless they owe more than $600 per child in income tax, there is no tax left to offset with the child care credit — so they receive no additional benefit from the child care credit," Maag said.

When considering all the changes in the tax bill, the Tax Policy Center found that the cuts would benefit the highest fifth of earners the most, largely due to cuts to corporate income tax, reductions in taxation of business income and the estate tax.

"Very few tax-lowering changes in the bill are targeted at families with children — and none at families with very young children," the Tax Policy Center wrote in November 2017 shortly before the bill passed.

Race horses and the tax code

There were some changes in the tax bill that didn’t specifically target race horses but did help the industry.

The largest change is full expensing, which lets a taxpayer who bought a racehorse (or many other long-term assets) write off that cost in the first year, unlike three years under the previous tax code, said Patrick Newton, spokesman for the Committee for a Responsible Federal Budget.

For example, under the 2017 bill, a business with $50,000 in revenues that spent spent $50,000 buying a racehorse would have zero in taxable income. Under prior law, they would have had to take the $50,000 deduction over time so they would have some taxable income.

Before the 2017 tax bill, there was a separate provision in the tax code specifically about racehorses.

Congress passed a 2008 farm bill that included a provision to allow racehorses to be depreciated over three years, rather than the previous seven years.

This provision expired at the end of 2017 and is one of the tax extension measures that Congress keeps trying to restore, said Howard Gleckman, an expert at the Tax Policy Center.

Our ruling

Biden said, "Why should you get a break for racehorses and not get a break for child care?"

Biden wants a larger tax break for working parents, but his statement creates a misleading impression that none currently exists.

The child care tax credit, which was not changed by the 2017 bill signed by Trump, gives a tax credit to parents who paid for day care, after school care or summer camp for a child under age 13. Usually the credit applies to 20% of expenses up to $3,000 for a child. Separately, the tax bill did increase the child tax credit.

As for horses, the tax bill allows a write-off for purchasing a racehorse (among other items) in the first year.

Biden’s claim contains an element of truth but ignores critical facts that would give a different impression. We rate it Mostly False.

Our Sources

Joe Biden, Speech in Iowa and CNN transcript, June 11, 2019

Congressional Research Service, Tax Provisions That Expired in 2017 ("Tax Extenders"), Oct. 25, 2018

Tax Policy Center, Impact of the Tax Cuts and Jobs Act on Families with Young Children, Nov. 28, 2017

U.S. Senate, Summary of the Tax Extender and Disaster Relief Act of 2019

National Thoroughbred Racing Association, Statement about tax bill, Dec. 20, 2017

AP, What's a tax break for car racing doing in the budget deal?; What's a tax break for car racing doing in the budget deal? Feb. 9, 2018

CQ, Vice President Joe Biden remarks at a Hillary for America event, (Accessed in Nexis) Nov. 4, 2016

The Horse, Three-Year Depreciation of Racehorses Not Extended to 2017, Dec. 13, 2016

Child Care Aware, U.S. and the high cost of child care, 2018

Brookings, Three proposals to give Americans a tax break and increase labor force participation, April 15, 2019

PolitiFact’s Trump-O-Meter, Tax bill doesn't increase deductions for dependent care expenses, Dec. 21, 2017

Interview, Chris Edwards, director of tax policy studies, Cato Institute, June 12, 2019

Interview, Patrick Newton, Committee for a Responsible Federal Budget spokesman, June 12, 2019

Interview, Howard Gleckman, Tax Policy Institute senior fellow, June 12, 2019

Interview, Elaine Maag, Tax Policy Institute principal research associate, June 12, 2019

Interview, Andrew Bates, Joe Biden campaign spokesman, June 13, 2019

Browse the Truth-O-Meter

More by Amy Sherman

Joe Biden says there are tax breaks for racehorses, not child care. That’s misleading

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.