Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

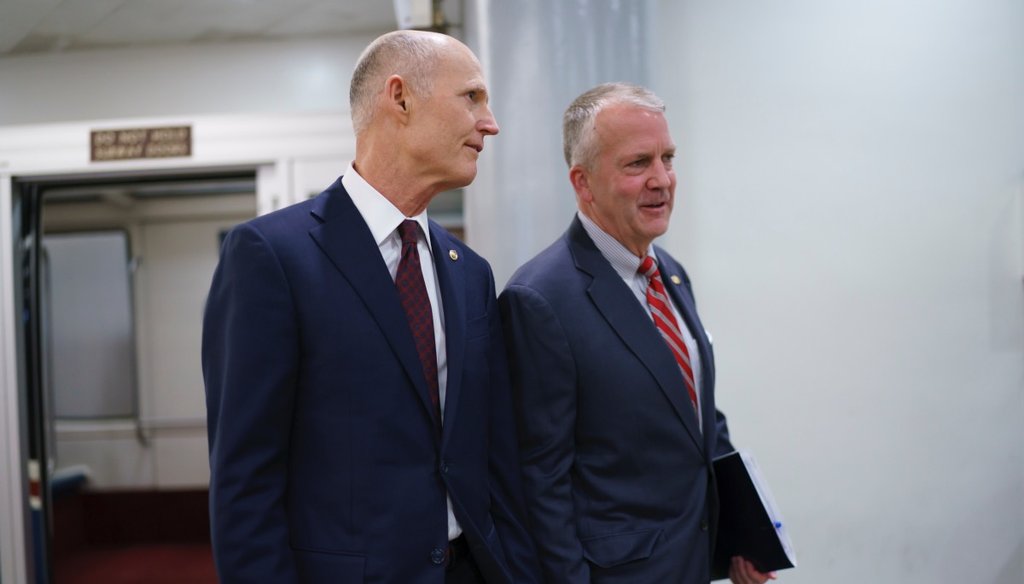

Sen. Rick Scott, R-Fla., left, and Sen. Dan Sullivan, R-Alaska, arrive for votes on amendments to advance the $1 trillion bipartisan infrastructure bill at the Capitol. (AP Photo/J. Scott Applewhite)

The American Rescue Plan Act, backed only by Democrats, sent stimulus checks of $1,400 to individuals and $2,800 to couples.

The law increased the Child Tax Credit, providing families with children an additional $4,380 on average.

The law expanded the Earned Income Tax Credit for lower-income workers, netting them on average about $850.

Florida Republican Sen. Rick Scott has been hammering President Joe Biden and the Democrats on inflation. Even as a COVID-19 outbreak ravages his state, Scott said he thinks inflation is the biggest issue Floridians are dealing with.

Many investment analysts believe that the current high inflation will be short-lived, but there is no denying that it is up. In June, the Consumer Price Index rose 5.4% from a year earlier, the fastest pace since August 2008.

Scott isn’t just blaming Democrats for inflation. He accuses them of ignoring the issue.

"Biden and the Democrats say they care about Americans, but they have done absolutely nothing to help families struggling to keep up with inflation," Scott said in a July 30 press release. "We are nearly $30 trillion in debt, but Democrats have no plans to slow down their spending."

Democrats do plan to spend a lot more money, both through the bipartisan infrastructure bill — roughly $1 trillion — and a budget reconciliation package that could top $3 trillion. Some of that might be paid for through higher taxes on corporations and high income earners. That wouldn’t be inflationary. But broadly, economic theory suggests that heavy government spending could trigger long-term inflation if the economy is not able to absorb it fast enough.

But here we focus on Scott’s statement that Democrats have left families totally exposed to higher inflation without doing anything to help.

That ignores a lot, particularly the tens of billions of dollars Biden and the Democrats have distributed to millions of American households through the American Rescue Plan Act — which passed in March without a single Republican vote in the Senate or House.

According to the Tax Policy Center, a Washington-based neutral source of tax policy estimates, the American Rescue Plan Act will raise after-tax incomes, on average, by 3.8%. Low- and moderate-income households do best under the law, getting about 70% of all the benefits.

We reached out to Scott’s office and did not hear back. Here’s a closer look at what Scott’s statement overlooks.

The pandemic relief package offered $1,400 to nearly every person who filed a tax return. Couples making up to $150,000 would get $2,800. The benefit tailed off quickly for incomes above the $150,000 mark. The average payment per household is $2,300, and the money is tax-free.

The lowest fifth of all taxpayers, or those making less than about $26,000, saw the biggest relative increase in their incomes from the relief checks, 14.6%. In raw dollars, people in the second-highest income group — those making between about $80,000 and $130,000 — got the biggest payments, an average of $2,930.

The middle income group, with incomes of roughly $50,000 to $80,000, receive an average of $2,630, and the group second from the bottom, incomes in about the $26,000 to $50,000 range, receive an average of $2,420.

The law increased the size of the Child Tax Credit. Most families get a minimum credit of $3,000 for each child under 18. For any child younger than 6, the amount rises to $3,600.

The average family with children gains $4,380. Except for the top fifth of income earners, the size of the benefit varies little across the income groups. Taking all households together — those with kids and those without — the average gain is $1,330.

The Earned Income Tax Credit dates back to 1975, and it’s aimed at helping low-income working families with children. Whatever they earn, the government gives them just a little bit more on top. The American Rescue Plan Act greatly expanded the credit in terms of dollars and eligibility.

The law nearly tripled the maximum amount of the tax credit from $543 to $1,502 for workers with children who don’t meet every legal condition as being part of the household (non-custodial, non-biological children). It raised the income threshold at which the credit begins to phase out — from $8,880 to $11,610 if single, and from $14,820 to $17,550 if married. It expanded the age range, opening it up to workers 19 to 24, and to those over 65.

As a result, workers in the lowest two quintiles — roughly, those making less than $50,000 — stand to gain about $850 on average. Across all taxpayers — including the high earners who aren’t eligible — the average benefit is $470.

Scott said Biden and the Democrats had "done absolutely nothing to help families struggling to keep up with inflation."

A credible estimate from the Tax Policy Center finds that the American Rescue Plan Act will raise the average after-tax income by 3.8%, with low- and moderate-income households gaining the most.

We don’t know how the prices of basics like food, gas and clothing will change over the coming months, or how the current influx of government spending will affect inflation rates. But the law backed by Biden and the Democrats will give Americans more money to help cover their bills.

We rate this claim False.

Rick Scott, Sen. Rick Scott Issues Weekly Update on Biden’s Inflation Crisis, July 30, 2021

Congressional Research Service, The "Childless" EITC: Temporary Expansion for 2021 Under the American Rescue Plan Act of 2021,May 3, 2021

Urban-Brookings Tax Policy Center, Economic impact payments, March 8, 2021

Urban-Brookings Tax Policy Center, Tax Benefit of the CTC, EITC, and CDCTC, March 23, 2021

Urban-Brookings Tax Policy Center, Tax Benefit of the Child Tax Credit, March 12, 2021

Urban-Brookings Tax Policy Center, Tax Benefit of the Earned Income Tax Credit, March 23, 2021

C-SPAN, Senate Republican leadership news conference, Aug. 3, 2021

Email exchange, Howard Gleckman, senior fellow, Urban-Brookings Tax Policy Center, Aug. 3, 2021

In a world of wild talk and fake news, help us stand up for the facts.