Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

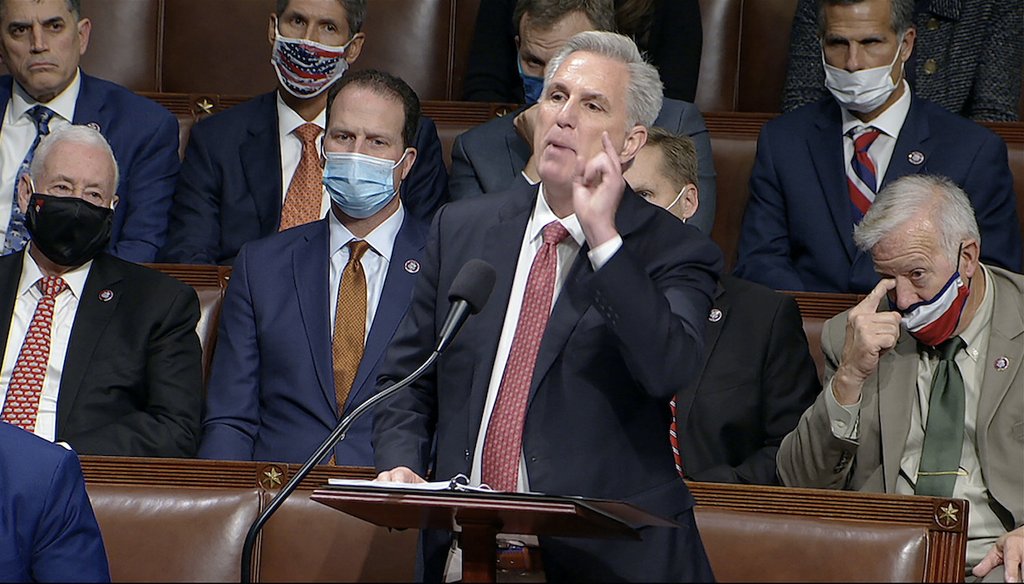

House Minority Leader Kevin McCarthy of Calif., speaks on the House floor during debate on the Democrats' expansive social and environment bill at the U.S. Capitol on Thursday, Nov. 18, 2021, in Washington. (House Television via AP)

• McCarthy is wrong on all three counts.

• Two bills, including a broadly bipartisan measure signed by then-President Donald Trump, spent more money at one time than the Build Back Better bill passed by the House.

• As a share of gross domestic product, the tax increases in the Build Back Better bill rank sixth since 1968 and 16th since World War II.

• Two bills, including the bipartisan measure signed by Trump, added far more to the debt than the Build Better Back bill would.

During his marathon floor speech before House passage of the Build Back Better bill, House Minority Leader Kevin McCarthy, R-Calif., criticized the Democratic-backed measure as profligate and harmful to the economy.

Starting on Nov. 18, McCarthy spoke for more than eight hours prior to the final vote on the bill. The version that passed the House, which may be changed in the Senate, would spend $1.75 trillion over 10 years on clean energy initiatives, child care subsidies, extended child tax credits, paid family leave and hearing aids for Medicare beneficiaries. It would be partially paid for through additional taxes primarily aimed at wealthy taxpayers and by letting the government negotiate certain drug prices.

At one point in his speech, McCarthy said, "Never in American history has so much been spent at one time. Never in American history will so many taxes be raised and so much borrowing be needed to pay for this reckless spending."

It seemed unlikely that a bill that raises historic levels of taxes to pay for its spending would also require historic levels of borrowing. So we decided to take a closer look at McCarthy’s assessment.

It turns out McCarthy was wrong on all three elements. (His office did not provide support for his remarks to PolitiFact.)

Two recent measures signed into law spent more at one time, one signed by then-President Donald Trump and the other signed by President Joe Biden.

The Coronavirus Aid, Relief, and Economic Security (or CARES) Act was passed with bipartisan support and signed by Trump in March 2020, as the scope of the coronavirus pandemic was becoming clear.

The measure provided a $1,200-per-adult and $500-per-child direct cash payment, expanded unemployment benefits, a government-funded business lending plan, and expenditures to support hospitals, schools, and state and local governments.

In all, the expenditures in the CARES Act totaled $2.3 trillion, which is well above the price tag of the Build Back Better bill, and the money in the CARES Act was designed to be infused into the economy more quickly.

Another bill signed by Biden in March 2021 also exceeded the cost of the Build Back Better Act. This measure, the American Rescue Plan, was supported only by Democrats in both chambers.

The $1.9 trillion measure provided means-tested $1,400 direct cash payments, an increase in the child tax credit, an extension of enhanced unemployment payments, rental assistance, and funding for state and local governments, as well as schools, transit, restaurants, child care, and the airline industry.

The Congressional Budget Office, the nonpartisan arm of Congress that examines the spending and tax impacts of legislation, found that the Build Back Better bill would raise taxes by roughly $1.27 trillion over 10 years.

The CBO has previously estimated the size of the nation’s gross domestic product over the next decade at just under $288 trillion.

So over the 10-year period, the tax increases from the Build Back Better bill would represent about 0.44% of cumulative GDP.

That’s not trivial, but it’s also not close to a record.

Just since 1968, at least five tax bills enacted tax increases larger than 0.44% of GDP:

• Revenue and Expenditure Control Act of 1968: 1.09%

• Tax Equity and Fiscal Responsibility Act of 1982: 0.8%

• Crude Oil Windfall Profit Tax Act of 1980: 0.5%

• Omnibus Budget Reconciliation Act of 1993: 0.5%

• Omnibus Budget Reconciliation Act of 1990: 0.49%

In addition, 10 other bills before and during World War II also increased taxes by a larger percentage of GDP, according to the Treasury Department.

This may be the most off-base assertion of the three.

The CBO analysis of the Build Back Better bill found that the deficit would increase over 10 years by between $160 billion and $367 billion. (The lower figure reflects increased tax collections from additional IRS audit capacity, which the CBO’s rules don’t officially consider.)

Those increases are a small fraction of the other two coronavirus relief bills mentioned earlier.

According to the CBO, the CARES Act would raise deficits by $1.7 trillion, and the American Rescue Plan would raise deficits by about $1.8 trillion.

"It seems like there’s a bit of short-term memory loss" with McCarthy’s statement, said Steve Ellis, president of Taxpayers for Common Sense. He added that "it’s just bad math to think that so much spending and so much revenue in Build Back Better wouldn’t largely cancel each other out (even if not entirely), so as not to add that much to the deficit."

McCarthy said, "Never in American history has so much been spent at one time. Never in American history will so many taxes be raised and so much borrowing be needed to pay for this reckless spending."

He’s wrong on all three counts. Two bills, including the bipartisan CARES Act, spent more money at one time. As a share of gross domestic product, the tax increases in the Build Back Better bill only rank sixth since 1968 and 16th since World War II. And the CARES Act was one of two bills that added far more to the debt than the Build Better Back bill would.

We rate the statement False.

Kevin McCarthy, floor speech, Nov. 18-19, 2021

Treasury Department, "Revenue Effects of Major Tax Bills," February 2013

Congressional Budget Office, "Summary of Cost Estimate for H.R. 5376, the Build Back Better Act," Nov. 18, 2021

Congressional Budget Office, analysis of the CARES Act, revised April 27, 2020

Congressional Budget Office, "Estimated Budgetary Effects of H.R. 1319, American Rescue Plan Act of 2021," March 10, 2021

Congressional Budget Office, "An Update to the Budget and Economic Outlook: 2021 to 2031," July 2021

Reuters, "Joe Biden’s proposed tax increase is not the largest in U.S. history," Oct. 22, 2020

Email interview with Steve Ellis, president of Taxpayers for Common Sense, Nov. 19, 2021

In a world of wild talk and fake news, help us stand up for the facts.