Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

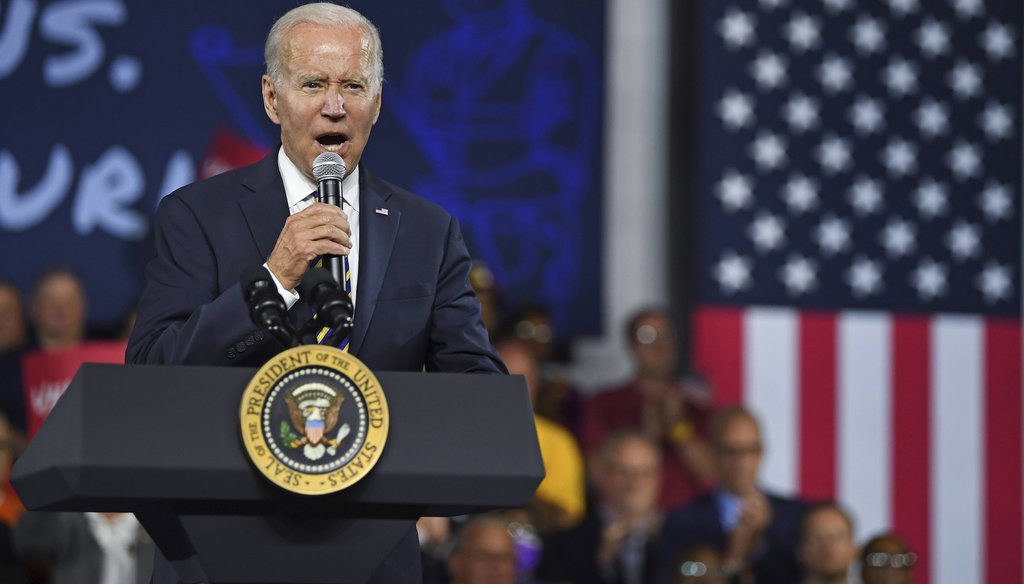

President Joe Biden speaks at Max S. Hayes Hight School in Cleveland on July 6, 2022. (AP)

Joe Biden’s dubious math on the federal income tax burden

If Your Time is short

• Today, the richest Americans pay an effective tax rate of more than 20% on the income the government counts under the current tax code. Biden’s 8% figure compares their tax payments to an amount that includes income that is not currently taxed under law. This makes it a theoretical figure.

• Among households earning $50,000 to $100,000 a year — a category that would include most of the rank-and-file taxpayers Biden mentioned — the vast majority paid effective tax rates of between zero and 15%, which is not two to three times the rate that the richest pay.

During a recent speech on the economy in Cleveland, President Joe Biden sought to spotlight the difference in tax burdens between the richest Americans and more typical taxpayers.

"Billionaires in America — there’s 789 or thereabouts. You know what average federal income tax they pay? 8%," Biden said July 6. "Every one of you have a job (in which you pay) more than 8% (in taxes) — every single one of you. If you’re a cop, a teacher, a firefighter, union worker, you probably pay two to three times that."

However, tax specialists say that Biden’s comparison is faulty. First, the 8% figure is a lowball estimate that uses a hypothetical calculation. And second, Biden’s statement ignores that most of the middle-income households he’s referring to pay tax rates of between zero and 15%.

"The claim is dishonest and deceptive," said Alex Muresianu, a federal policy analyst at the Tax Foundation.

Do the richest Americans pay an average federal income tax of 8%?

The first part of Biden’s statement is misleading.

Sign up for PolitiFact texts

The White House told PolitiFact that the figure comes from a White House report that looked at what would happen if the United States were to tax unrealized gains on stocks. Currently, if someone sees their stock shares rise in value over time, those gains are not taxed unless and until the shares are sold. If the shares are never sold, then they are never taxed, and under current law — which Biden has proposed changing — they may be passed on to the next generation with little or no taxation. (Despite the similar sounding name, unrealized gains are different from capital gains taxes; capital gains taxes are levied when the stock is sold.)

The White House report found that if you include unrealized gains in the income calculations of the 400 richest U.S. families, then their taxes paid would account for just 8.2% of their income.

Economists and policymakers have long debated whether the government should tax unrealized gains. But Biden made it sound like 8% was the standard rate today, not what would happen under a future proposal.

What is the actual tax burden under the current tax code for the wealthiest Americans? IRS data from 2019 shows that the top 1% of taxpayers paid an average federal income tax rate of 25.6%, or about three times more than the White House’s estimate. A more elite group, the top 0.001% — which in 2019 meant people earning about $60 million or more — paid a percentage that was only modestly smaller, 22.9%.

"Using the existing definition of taxable income, really rich people pay an average federal income tax rate in the mid-20s," said Howard Gleckman, a senior fellow at the Urban Institute-Brookings Institution Tax Policy Center. "If you want to include unrealized gains in your denominator, as the White House does, the average rate would go way down."

Do typical workers pay tax rates two to three times higher than wealthy Americans?

Biden is offbase on middle-class tax rates, too.

For starters, Biden’s statement ignores that 43.6% of households paid zero or negative net federal individual income taxes in 2019, according to the Urban Institute-Brookings Institution Tax Policy Center. (The percentage was higher in 2020, but that was because of temporary tax relief provisions during the coronavirus pandemic, so tax experts said it’s best to use the prepandemic figure from 2019.)

That’s a lot of Americans paying zero federal income taxes. They may have paid payroll or other federal taxes, and potentially state or local taxes, but Biden specifically cited the "federal income tax" in his remarks.

For a sense of scale, the bottom 40% of American incomes in 2018 included those earning below about $43,000 a year.

Featured Fact-check

The specific professions Biden cited earn a bit more than $43,000. The median annual income without overtime for police officers is $64,605; it’s $50,939 for firefighters and $67,080 for K-12 teachers.

Still, measured by actual taxes paid under current law, the effective tax rate for incomes in this range are not two or three times higher than what the wealthiest pay.

For households with adjusted gross incomes between $50,000 and $100,000, the Tax Policy Center found, a plurality of 42% paid an effective tax rate between 5% and 10%, while another 30% paid an effective rate between 10% and 15%. Also, 15% of those households paid an effective overall rate below 5%, and another 5% paid nothing at all or got money back from the government.

In addition, while ordinary Americans have smaller stock holdings than the richest families do, many middle-income Americans have retirement accounts with plenty of unrealized income. Biden’s comparison takes unrealized income into account for the richest Americans, but not for ordinary Americans.

Our ruling

Biden said the "average federal income tax" paid by the richest Americans is "8%. … If you’re a cop, a teacher, a firefighter, union worker, you probably pay two to three times that."

Today, the richest Americans pay an effective tax rate of more than 20% of their income as counted under the current tax code, not 8%.

Meanwhile, among households earning between $50,000 and $100,000 a year, the vast majority paid effective tax rates of between 0 and 15%, which is not two to three times the rate that the richest pay.

Biden’s statement is not accurate. We rate it False.

Our Sources

Joe Biden, remarks in Cleveland, July 6, 2022

White House, "What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans?" Sept. 23, 2021

White House, "New OMB-CEA Report: Billionaires Pay an Average Federal Individual Income Tax Rate of Just 8.2%," Sept. 23, 2021

Urban Institute-Brookings Institution Tax Policy Center, "Tax Units with Zero or Negative Income Tax, 2011-2031," accessed July 13, 2022

Urban Institute-Brookings Institution Tax Policy Center, "Historical Income Distribution for Nonelderly Childless Households," accessed July 13, 2022

Urban Institute-Brookings Institution Tax Policy Center, "Effective Tax Rate by Size of Income," accessed July 13, 2022

Tax Foundation, "Summary of the Latest Federal Income Tax Data, 2022 Update," Jan. 20, 2022

Bureau of Labor Statistics, "National Occupational Employment and Wage Estimates," May 2021

CBS News, "America's billionaires pay an average income tax rate of just 8.2%, Biden administration says," Sept. 23, 2021

Email interview with Alex Muresianu, federal policy analyst at the Tax Foundation, July 12, 2022

Email interview with Howard Gleckman, senior fellow at the Urban Institute-Brookings Institution Tax Policy Center, July 12, 2022

Browse the Truth-O-Meter

More by Louis Jacobson

Joe Biden’s dubious math on the federal income tax burden

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.