Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

Pumpjacks draw oil out of the ground in a field near Lovington, N.M. (AP Photo/Charlie Riedel)

Kevin McCarthy said domestic oil is more affordable than imported oil. It costs more

If Your Time is short

-

American refineries pay more for domestic oil than imported oil; on average over the past 10 years, about 5% more.

-

Saudi Arabia and other Middle East nations have the lowest production costs of any region.

For House Minority Leader Kevin McCarthy, R-Calif., President Joe Biden’s planned meeting with Saudi Arabian leaders — including Crown Prince Mohammed bin Salman Al Saud, who U.S. intelligence concluded ordered the murder of a Saudi dissident — was proof of a flawed policy.

"A 12-hour, non-stop international flight," McCarthy tweeted June 17. "That’s how far President Biden would rather travel to plead for Saudi Arabian oil rather than simply issue more drilling permits to producers here at home. American oil is cleaner. More reliable. And more affordable. Put America FIRST!"

We focused on the pocketbook issue in that tweet. Americans are struggling with gas prices that top $5 a gallon, and McCarthy’s pitch that oil from home is more affordable might seem like common sense. Shipping oil across an ocean sounds more expensive than pumping it here at home.

But the power of global market pricing and the cost of getting oil out of the ground and to refineries undercut McCarthy’s claim.

Gas prices in brief

McCarthy’s spokesperson Mark Bednar said the proof lies in the law of supply and demand.

Sign up for PolitiFact texts

"If we had more American energy production, we could lower the global price by increasing supply," Bednar said.

McCarthy’s tweet didn’t say domestic production would lead to lower prices. It said domestic oil was, in itself, more affordable compared with Saudi Arabian oil.

But even accounting for Bednar’s explanation, McCarthy’s statement runs into a problem of scale. The global market is huge, and American production is relatively small, said analysts with the Federal Reserve Bank of Dallas, a branch of the Federal Reserve System.

"Even under the most optimistic view, U.S. production increases would likely add only a few hundred thousand barrels per day above current forecasts," the analysts wrote in May. "This amounts to a proverbial drop in the bucket in the 100-million-barrel-per-day global oil market."

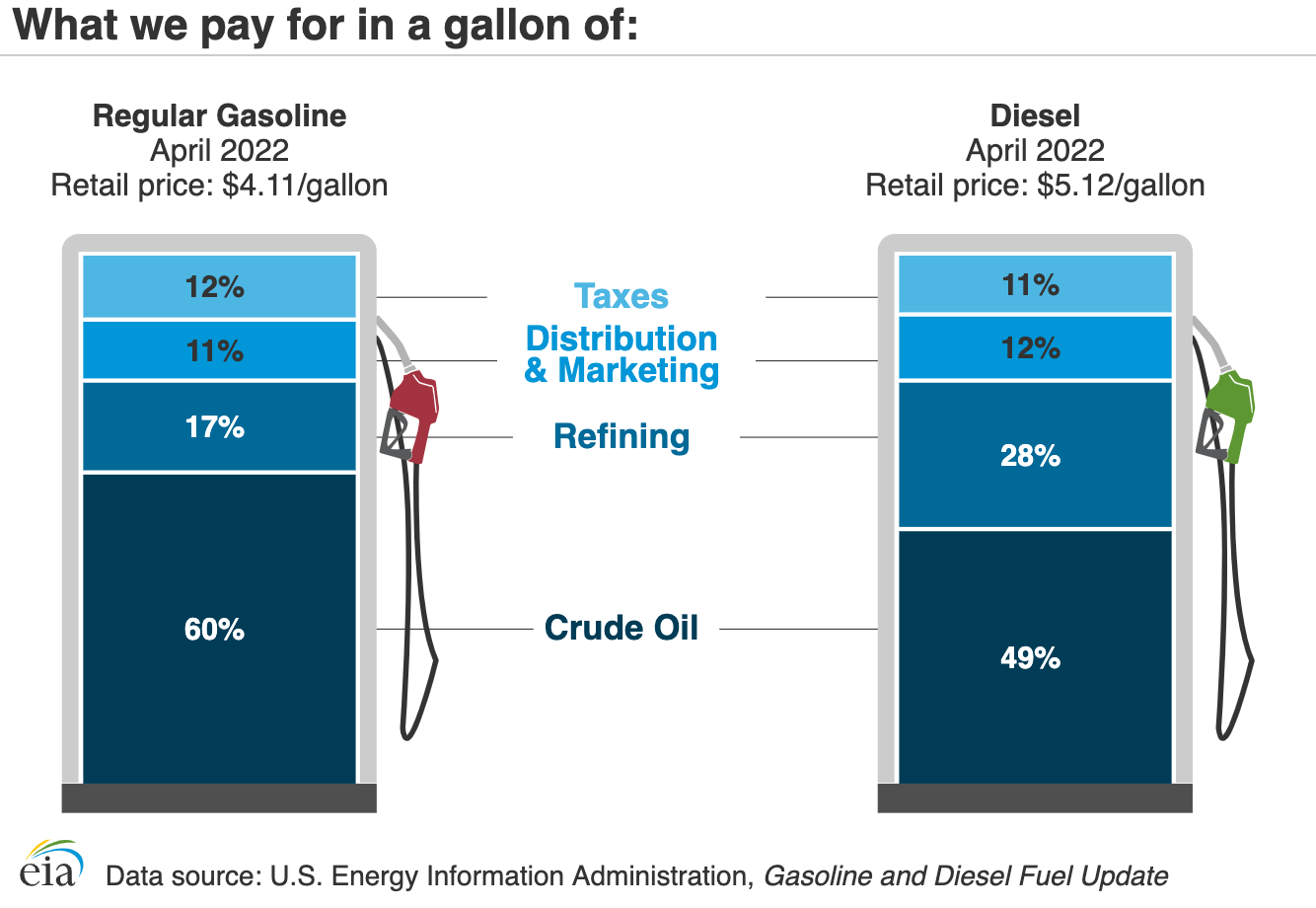

Global markets matter because the single biggest factor behind the price of gasoline is the price of crude oil. Refineries change crude oil into petroleum products to fuel vehicles.

In April, crude oil accounted for 60% of the price of gasoline, according to the U.S. Energy Information Administration.

Since the initial economic wallop from the coronavirus in the spring of 2020, demand for oil has risen steadily as business activity has increased. Supply hasn’t been able to keep up due to delays in restoring drilling capacity, higher transportation costs, and sluggish production increases.

And the price of oil on the global market is what American gasoline producers have to deal with.

"The first thing to know about oil is that it is set on a GLOBAL market," MIT energy economist Christopher Knittel tweeted in March. "There is, effectively, one price. So, any supply disruption, anywhere, affects that price and therefore prices in the U.S."

It’s not as though increased domestic production would have no impact, but Knittel said it would be diluted. If American production rose by a whopping 10%, it would add over 1 million barrels a day to global supplies.

"Sadly, that's only 1% of world production," Knittel wrote. "Would it lower prices? Sure. But not by as much as people often think."

And a production hike would take time. Today, the U.S. produces 11.7 million barrels a day. Government forecasters estimate it will take about another year before the country adds another million barrels to that.

For those who argue that trend is because of Biden administration policies, it’s oil producers who have held back investments, as they balance financial goals against the future price of oil.

Domestic oil costs more

Looking at what McCarthy actually said — that domestic oil is itself more affordable — the numbers don’t back that up. Saudi oil is easily produced, and transporting it is not a major factor.

"The costs of importing oil from Saudi Arabia are very low," said Eric Lewis, an energy economist at Texas A&M University. "Shipping overseas from a place that has oil export facilities is easy."

Featured Fact-check

In talking about affordability, McCarthy introduced an ambiguous concept. Affordability could be limited to the cost of just getting the oil out of the ground. It could mean that cost, plus the expense of moving the oil to a refinery.

The Energy Information Administration tracks how much refiners pay for domestic and imported oil.

In the past 10 years, domestic oil has cost more. You have to go back to November 2012 to find a month when the cost of a barrel of domestic oil was less than a barrel of imported oil. In April, the most recent month for which we have numbers, a barrel of domestic oil cost $7.13 more than a barrel of imported oil. Since February 2021 — the month when the price returned to its pre-pandemic level — domestic oil has cost an average of $4.06 more per barrel.

It doesn’t help McCarthy’s case if we look solely at the cost of getting oil out of the ground. In terms of data, this is a tricky area. Particularly for the world’s second largest producer, Saudi Arabia, energy analyst Lutz Kilian at the Federal Reserve Bank of Dallas said there is no official source.

"Saudi Arabia’s numbers are a closely guarded state secret, but are thought to be very low," Kilian said, referring to Saudi production costs.

The private energy research firm Rystad Energy has a unique way of measuring what it takes to produce oil in different regions. Rystad’s yardstick looks at future costs, and so might not match other methods of estimating production costs. But if nothing else, it helps show how different production regions stand relative to each other.

In Rystad’s 2020 analysis, at $31 a barrel, onshore Middle Eastern oil fields have the world’s lowest production cost. For deepwater wells, which would include some U.S. production, the number is $43 a barrel, and for North American oil produced through fracking (hydraulic fracturing), the cost is $44 a barrel. Other North American sources cost even more.

Again, U.S. oil costs more than oil from Saudi Arabia and its neighbors.

Our ruling

McCarthy said that domestic oil is "more affordable" than foreign oil.

His spokesperson said that was true because more oil from the U.S. would increase global supplies and lead to lower prices. That isn’t what McCarthy’s tweet said, but even if that’s what he had in mind, experts said any impact on the price of gasoline would take about a year to materialize and would be modest even then.

Taking McCarthy’s words at face value, domestic oil is not more affordable. Whether looking at the price paid by refineries, or the simple cost of production, domestic oil costs more than imported oil.

We rate this claim False.

Our Sources

Kevin McCarthy, tweet, June 17, 2022

U.S. Energy Information Administration, Refiner acquisition cost of crude oil, June 1, 2022

Federal Reserve Bank of Dallas, Dallas Fed Energy Survey, March 23, 2022

U.S. Energy Information Administration, Gasoline and Diesel Fuel Update, June 113, 2022

U.S. Energy Information Administration, Monthly crude oil and natural gas production,May 31, 2022

U.S. Energy Information Administration, Short-term energy outlook, June 7, 2022

Federal Reserve Bank of Dallas, Don’t look to oil companies to lower high retail gasoline prices, May 10, 2022

Eurasian Ventures, The economy of breakeven oil prices, 2020

Rystad Energy, Rystad Energy ranks the cheapest sources of supply in the oil industry, May 9, 2019

Rystad Energy, Oil production costs reach new lows, making deepwater one of the cheapest sources of novel supply, Oct. 21, 2020

NBER, Limits on OPEC output increase global oil production costs, January 2018

Al Arabiya News, Saudi Arabia supported by world’s lowest oil cost amid price war, coronavirus, April 5, 2020

Federal Reserve Bank of Dallas, How the Saudi decision to launch a price war is reshaping the global oil market, April 2, 2020

Forbes, Saudi Aramco's breakeven oil price is higher than expected, April 1, 2019

Reuters, Drilling vs returns. U.S. oil producers' tradeoff as windfall tax threatens, June 13, 2022

Moscow Times, Russian oil production among most expensive in world, Nov. 12, 2019

Middle East Institute, Can Saudi Arabia win the oil price war?, April 8, 2020

Energy Economics, The Russia-Saudi Arabia oil price war during the COVID-19 pandemic, Auyg. 17, 2021

S&P Global, Russia, OPEC+ seen moving closer on fiscal breakeven oil prices, Dec. 2, 2021

Columbia Center on Global Energy Policy, Oil market black swans: COVID-19, the market-share war, and long-term risks of oil volatility, April 2020

Marketplace, Domestic oil could increase supply, but it won’t be cheap — or quick, March 9, 2022

Email exchange, Luzt Kilian, senior economic policy adviser, Federal Reserve Bank of Dallas, June 22, 2022

Email exchange, Eric Lewis, assistant professor of energy economics, Texas A&M University, June 17, 2022

Email exchange, Mark Bednar, spokesman, House Republican Leader Kevin McCarthy, June 17, 2022

Browse the Truth-O-Meter

More by Jon Greenberg

Kevin McCarthy said domestic oil is more affordable than imported oil. It costs more

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.