Get PolitiFact in your inbox.

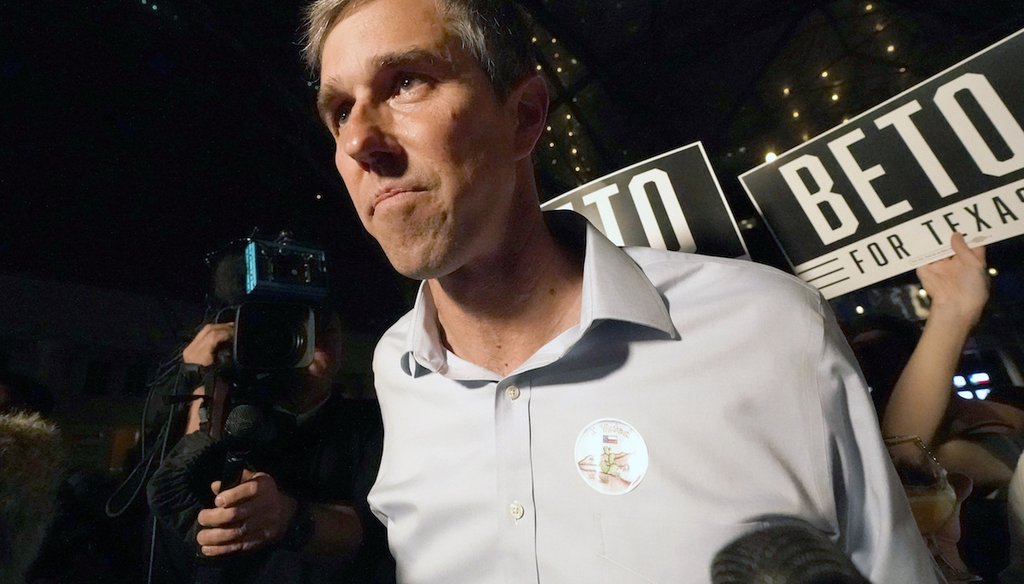

Texas Democrat gubernatorial candidate Beto O'Rourke listens to a question from a reporter during a primary election night gathering in Fort Worth, Texas, on March 1, 2022. (AP)

O'Rourke right about property tax going up under Abbott, but governor's role is indirect

If Your Time is short

- O'Rourke's right that estimated revenue collected through local property taxes increased by about $20 billion from 2015, when Gov. Greg Abbott first took office, to 2021.

- However, the governor's impact on property taxes is indirect because property taxes are set locally in Texas. The governor and state legislature can change the rules on propety taxes and have supported propety tax reform to mitigate the increases in property taxes that's matching rising property values.

Democratic gubernatorial candidate Beto O'Rourke is blaming Gov. Greg Abbott for high inflation in Texas, taking a page out of the GOP playbook in attacking President Joe Biden.

O'Rourke released an Instagram video on April 23 with the caption, "Greg Abbott is the single greatest driver of inflation in the state of Texas." TV news clips were stitched together with clips of O'Rourke speaking.

In one clip in the montage, O'Rourke says, "Under Greg Abbott, property taxes have gone up $20 billion."

O'Rourke went on to say, "When you add this to the other inflation that he's causing ... " with more clips pointing to electricity bills, traffic backups at the border in April due to additional commercial vehicle inspections Abbott ordered that he said would improve border security, and the rising costs of internet and phone for rural Texans.

Overall, O'Rourke is saying Abbott is exacerbating consumer prices in Texas, which were already rising nationwide.

We looked at one component of the ad: that jaw-dropping number of a $20 billion increase in property taxes. Is it true?

O'Rourke's source

Nationally, inflation hit a 40-year high according to March data from the Bureau of Labor Statistics, prompting criticism of Biden, especially as inflation relates to government spending.

O'Rourke's campaign pointed to a Texas Taxpayers and Research Association report titled "Relief from Rising Values: 2019 Property Tax Reforms Cutting Tax Rates at a Record Pace."

The report looked at the effects of legislation by state Sen. Paul Bettencourt, R-Houston, and state Rep. Dan Huberty, R-Houston, that overhauled the school finance system and local government budgeting practices and tamped down property tax increases for Texans. The association found property taxes are continuing to rise, but at a slower rate.

The campaign pointed specifically to a figure in the report depicting Texas local property taxes from 2011 to 2021. Property taxes levied were just over $50 billion in 2015, when Abbott took office, and just over $70 billion in 2021. The difference is about a $20 billion increase.

Data on estimated revenue from local property taxes is available on the state comptroller's website. According to the 2018-19 biennial report on property taxes by the comptroller's office, property taxes totaled $52.2 billion in 2015.

Comptroller data on school district, city, county and special district property taxes indicate there was an estimated $73 billion in property taxes collected statewide in 2021. That's at least a $20 billion increase and in line with the analysis by the Texas Taxpayers and Research Association.

In the six years before Abbott's election, property taxes increased to a lesser extent, but that property tax growth was constrained by the Great Recession.

To note, while O'Rourke is appealing to voters who may also be homeowners, both commercial and residential property taxes are included here.

Austin Community College economics professor Stuart Greenfield, whose state government career included work with economic models and how Texas distributes money to school districts, said just over half of the 2019 school district taxable value of property was single-family and multifamily homes.

Is Abbott to blame?

The Texas Taxpayers and Research Association is a lobbying organization that primarily spends its money on research. Its policy advocacy has a fiscal conservative bent, the association's President Dale Craymer said, but the organization doesn't advocate for the policies of one party over the other.

Craymer said O'Rourke spoke correctly of the group's report based on the data it analyzed from the comptroller's office.

The implication of O'Rourke's ad, however, is that Abbott is responsible for rising property taxes.

Craymer said the role of state government is indirect at best when it comes to property taxes because rates are set locally and not by the governor or Legislature.

"Basically, the process by which rates are set and adopted is laid out in state law," Craymer said. "The Legislature and the governor obviously are responsible for drafting and putting those laws in effect. But the state really doesn't have a direct say in the amount of property taxes individual jurisdictions raise."

The association's report found taxes would have been somewhat higher without two property tax changes by the Legislature in 2019.

One created a process where school district property taxes would decrease over time for senior citizens, whose school district taxes are capped.

The second change, Craymer said, increased the school district property tax homestead exemption for homeowners from $25,000 to $40,000, saving homeowners about $180 per year.

Also in 2019, the Legislature required cities, counties and most special districts to seek voter approval to set a property tax that raises revenues more than 3.5%. For junior colleges and hospital special districts, the threshold for voter approval is 8%. For school districts, it is 2.5%.

State policy also affects property values, and increases in value are tied to increases in taxes. Richard Auxier, senior policy associate at the Tax Policy Center under the Brookings Institute and Urban Institute, said the value of Texas homes is increasing alongside the rest of the country.

"While you can frame that as property taxes went up, you can flip that to home values went up," Auxier said. "It's always going to be a trade-off, because people want the value of their homes to increase, but people don't want their taxes to go up."

Texas Republicans have campaigned on property tax relief, too. Abbott added property tax relief to the Legislature's third special session agenda in 2021 that resulted in a now-approved amendment to the Texas Constitution. Abbott similarly publicized his support for property tax relief as a priority in a May 2 tweet ahead of May 7 elections.

Abbott's campaign responded to O'Rourke's ad by saying Abbott reduced property taxes by $18 billion since taking office and O'Rourke increased property taxes as an El Paso City Council member.

Texas voters approved Proposition 2, which raises the homestead exemption for school district property taxes from $25,000 to $40,000. They also approved Proposition 1, which corrected a 2019 oversight in tax relief that did not apply to homeowners who are disabled or 65 or older because their school tax burden is capped.

Our ruling

O'Rourke said in an April 23 Instagram video on rising inflation in Texas that, "Under Greg Abbott, property taxes have gone up $20 billion."

Data presented in biennial reports and on the comptroller's website show that estimated revenue collected through property taxes increased by more than $20 billion. O'Rourke's figure was accurate.

But property taxes are set locally, not by the state. Although state policies might indirectly affect property taxes, the governor's role in setting property taxes is indirect.

We rate this as Mostly True.

Our Sources

Instagram video posted by @betoorourke, April 23, 2022

U.S. Bureau of Labor Statistics, Economic News Release: Consumer Price Index Summary, April 12, 2022

Texas Taxpayers and Research Association, "Relief from Rising Values: 2019 Property Tax Reforms Cutting Tax Rates at a Record Pace," April 2022

Phone interview with Dale Craymer, president of Texas Taxpayers and Research Association, May 2, 2022

Phone interview with Richard Auxier, senior policy associate at the Urban Institute and Tax Policy Center, May 3, 2022

Phone interview with Stuart Greenfield, Austin Community College department of economics, May 5, 2022

Texas comptroller of public accounts, "Biennial Property Tax Report: Tax Years 2018 and 2019 Texas Property Tax"

Texas comptroller of public accounts, "Tax Rates and Levies" including the 2021 School District Rates and Levies, City Rates and Levies, County Rates and Levies, Special District Rates and Levies datasets

Email from Charles E. Gilliland, economist with the Texas Real Estate Research Center, May 13, 2022

Email from Kevin Lyons, spokesperson for the Texas Comptroller of Public Accounts, May 12, 2022

Follow-up phone call with Kevin Lyons, spokesperson for the Texas Comptroller of Public Accounts, May 12, 2022

Tweet by Greg Abbott (@GregAbbott_TX), May 2, 2022

"87th 3rd Called Session," Legislative Reference Library of Texas

Chuck Lindell, Austin American-Statesman "3rd special session ends with new political maps but no ban on vaccine mandates," Oct. 19, 2021

Chuck Lindell, Austin American-Statesman, "Texans overwhelmingly approve propositions on property tax breaks," May 7, 2022

Tweet by Texans for Abbott (@AbbottCampaign), April 20, 2022

Texans for Greg Abbott, "Beto's history of raising property taxes," April 20, 2022

Browse the Truth-O-Meter

More by Nusaiba Mizan

O'Rourke right about property tax going up under Abbott, but governor's role is indirect

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.