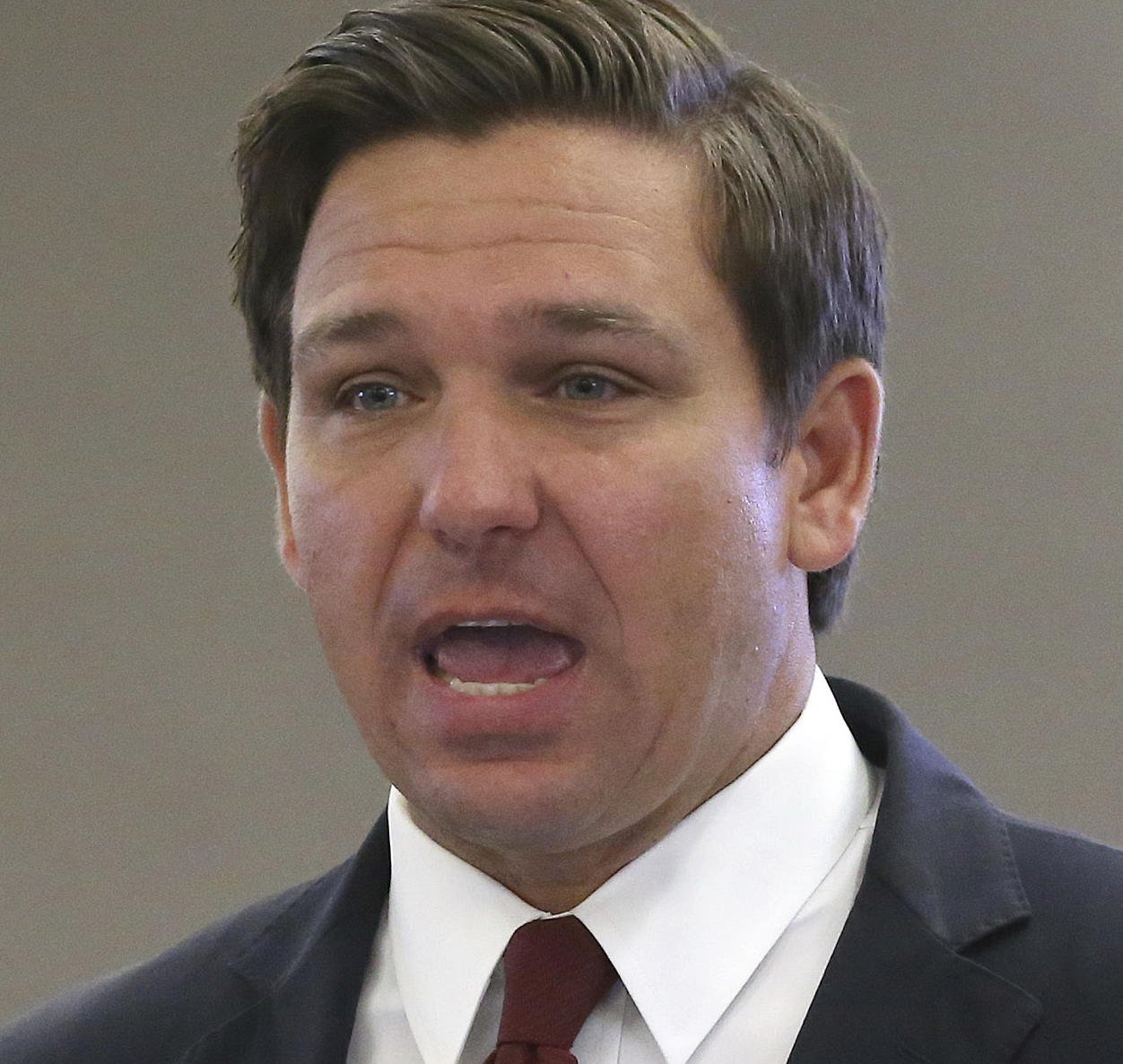

When he ran for governor, Ron DeSantis made multiple promises to lower or eliminate taxes that could hurt Florida residents and businesses. That included the state's corporate income tax, which returned to its 5.5% rate this year after being lower in several preceding years.

DeSantis promised in 2018 to "work to lower this business tax to encourage businesses to move to Florida and help Florida-based businesses continue to grow."

Before DeSantis took office, the corporate income tax rate was 5.5%. Through a series of changes — first federal, then state — the rate dipped to 4.458% from 2019-20 and 3.535% in 2021 before returning to 5.5% in 2022.

Corporate income tax in the state applies to all corporations that "conduct business, derive income or exist" within Florida, per the Florida Department of Revenue. The tax is calculated partly by using the business' federal income.

But lowering Florida's corporate income tax is complicated, because the rate is dictated largely by the federal tax code, according to Florida TaxWatch, a conservative think tank. As the group notes, Florida's Legislature every year passes a corporate income tax bill that adopts the federal Internal Revenue Code as it is on Jan. 1. State legislators have some discretion to lower the tax, but that discretion isn't always exercised, particularly when federal changes give them little time to act.

In December 2017, for example, Congress passed the Tax Cuts and Jobs Act, which cut the federal corporate income tax rate from 35% to 21% and broadened who was considered taxable under the corporate income tax by eliminating certain credits and deductions.

DeSantis, then a congressman, voted with House Republicans to pass the measure 227-203. (The Senate passed the measure on a party-line vote.)

During the following legislative session, the Florida Legislature adopted the Tax Cuts and Jobs Act's changes. But to offset the impacts, state lawmakers passed a bill, HB 7093, specifying that any corporate income tax collections exceeding current revenue estimates by more than 7% would be refunded to taxpayers.

The following year's corporate income tax would be lowered to the total rate that would bring in collections of the previous year's estimate plus the additional 7%. The rule was then extended by two more years.

These moves effectively reduced the state corporate income tax rate twice — once in 2019-20, to 4.458%, and once more in 2021, to 3.535%. Taxpayers received refunds of around $543 million in 2020 and around $624 million in 2022, according to numbers cited by Florida TaxWatch.

Nevertheless, actual taxes collected from 2018-19 to 2020-21 exceeded estimates from February 2018 by $962 million.

This is partly because the Tax Cuts and Jobs Act broadened the tax base; more people were paying the corporate income tax and total tax collections increased.

This year, the corporate income tax rate is slated to return to 5.5%, resulting in an estimated collection of $4.5 billion by 2025-26, the first fiscal year with no lingering refunds and rate reductions. About $2.4 billion was the most gross corporate income tax collected in one year in Florida before 2017's Tax Cuts and Jobs Act.

In 2021, the Florida Legislature passed roughly $31 million in tax credits that could be counted toward corporate income tax. Although DeSantis may not have specifically advised any relief for corporations, he supported the first round of tax refunds laid out in HB 7093.

A Governor's Office spokesperson also pointed to 2022's HB 7071, which included corporate income tax credit expansions, according to a press release.

Because the tax increases resulted largely from the federal government, taxpayers ultimately paid more in total than estimated and the rate has returned to 2019 levels, we rate this Promise Broken.