Get PolitiFact in your inbox.

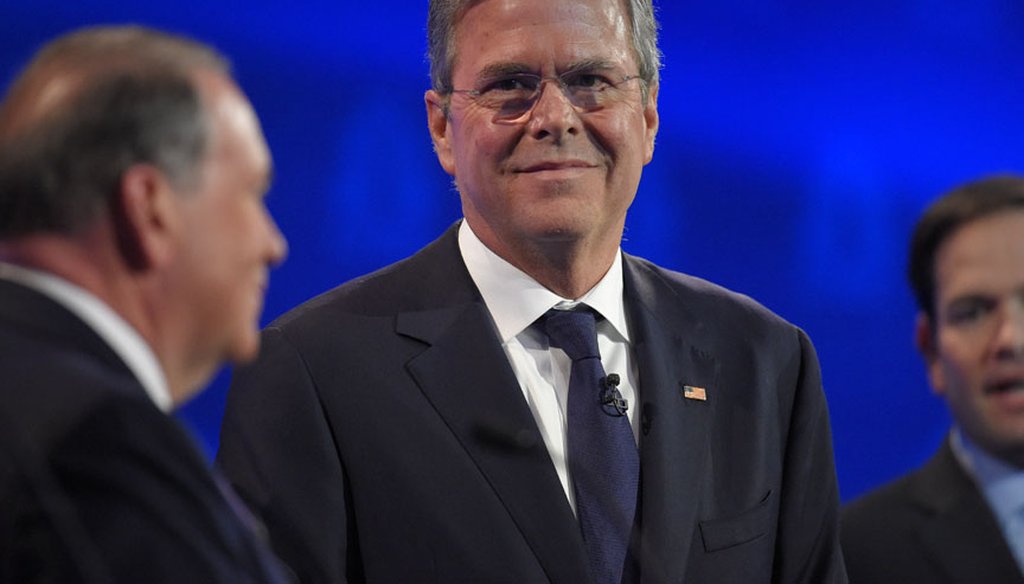

Jeb Bush stands between Mike Huckabee and Marco Rubio at the third GOP presidential debate on Oct. 28, 2015 in Boulder, Colo. (AP photo)

Jeb Bush says the middle class gets the biggest tax break under his plan

Former Florida Gov. Jeb Bush said at a recent debate that his plan to streamline the tax system will benefit everyone, but it will benefit the middle class the most.

"Look, the simple fact is that my plan actually gives the middle class the greatest break: $2,000 per family," Bush said during the Oct. 28, 2015, CNBC debate. He added that simplifying the tax code will boost economic growth.

We wondered, does the middle class really stand to benefit the most from Bush’s proposed tax cuts? That could be accurate if you examine the rates in a particular way, experts told us, but in practice it’s likely the highest earners would see the real windfall from Bush’s plan.

The Reform and Growth Act of 2017

Bush released his tax plan in September 2015, with an emphasis on streamlining the code, lowering rates and easing up on corporate taxes. Some analyses point out the plan could add to the budget deficit.

Bush’s plan:

• Cuts the number of personal income tax brackets from seven to three with rates of 10, 25 and 28 percent, down from a current top rate of 39.6 percent;

• Lowers the top corporate tax rate and taxes on capital gains to 20 percent;

• Eliminates the estate tax, gift tax, Alternative Minimum Tax and the Affordable Care Act (and its 3.8 percent surtax on investment income);

• Limits itemized deductions to 2 percent of adjusted gross income, except for charitable contributions, and eliminates deductions for state and local taxes;

• Increases standard deductions for single filers by $5,000 and for joint filers by $10,000 and doubles Earned Income Tax Credit for childless workers.

It’s the last point that Bush’s campaign has claimed will be one of the biggest boosts to the middle class.

There are myriad ways to define "middle class," but several experts told us a good rule of thumb is a family of four making the median family income, which was $53,657 in 2014. When we asked the Bush campaign for specifics, they referred us to the plan online, which includes a table showing their calculations for how the changes would affect certain levels of income.

According to Bush, the savings after paying taxes are a higher percentage gain for middle incomes than for higher incomes. Some analysts and economists we contacted said that $2,000 figure could be about right, considering the difference in the 25- and 28-percent tax brackets Bush proposes.

But one caveat is that his comparison is only counting people who take the standard deduction when filing their income tax returns. Because people with higher incomes tend to itemize, that means the sample of wealthy people to which Bush is comparing his middle class savings is much smaller than it could be.

Vanessa Williamson, a governance studies fellow at the Brookings Institution think tank, said roughly 90 percent of people making more than $100,000 per year itemize, and higher for people who earn more than that. Only about 58 percent of people making between $50,000 and $75,000 itemize.

"Wealthier people are not, as a general rule, filling out the 1040EZ and calling it a day," said Williamson said. "The vast majority of high-income people itemize their taxes ... and cut their taxes a great deal by doing so." (Think Warren Buffet paying just 17 percent.)

Now, Bush’s plan does limit the value of itemized deductions, and many middle-class families would benefit from a higher standard deduction. Some researchers think this plan will significantly decrease the number of people who itemize by simplifying their returns.

Other analyses, however, show that the highest earners get a much bigger break than Bush has implied, because they would benefit disproportionately from changes like lowering corporate taxes and repealing the estate tax.

One report by research group Citizens for Tax Justice, which advocates for tax fairness, said the middle fifth of earners would see a 3.2 percent change in their income, but the top 1 percent would realize a 10.2 percent benefit. They said middle income families would be getting $1,572 back, but the top 1 percent would average more than $177,000.

The pro-business Tax Foundation examined the plan, too. A projection based on exceptionally robust growth showed middle earners saw their adjusted gross incomes go up as much as 12.9 percent over an unspecified length of time. The top 1 percent’s incomes would go up 16.4 percent.

Our ruling

Bush said, "My plan actually gives the middle class the greatest break: $2,000 per family."

Middle-class families could potentially realize a higher percentage tax break, based on Bush’s plan. But that’s only counting those who would file their tax returns using the standard deduction, something the wealthy aren’t likely to do.

Even with caps on itemized deductions, a range of experts said the wealthiest Americans stand to benefit more than the middle class, thanks to Bush’s proposed changes in corporate, estate and other taxes.

Bush’s statement contains an element of truth but ignores critical facts that would give a different impression. We rate it Mostly False.

Our Sources

Jeb Bush, CNBC GOP presidential debate, Oct. 28, 2015

Tax Foundation, "Most Americans Don't Itemize on Their Tax Returns," July 23, 2007

PolitiFact, "Warren Buffett says the super-rich pay lower tax rates than others," Aug. 18, 2011

Pew Research Center, "High-income Americans pay most income taxes, but enough to be ‘fair’?," March 24, 2015

Citizens for Tax Justice, "Jeb Bush's Tax Plan Gives Top 1% Average Tax Cut of Nearly $180,000," Oct. 28, 2015

U.S. Census Bureau, "Income and Poverty in the United States: 2014," September 2015

JebBush2016.com, Reform & Growth Plan, Sept. 8, 2015

Wall Street Journal, "Jeb Bush: My Tax Overhaul to Unleash 4% Growth," Sept. 8, 2015

NPR, "Jeb Bush Reveals Proposal To Rewrite Nation's Tax Code," Sept. 9, 2015

Cato Institute, "Assessing Jeb Bush’s Pro-Growth Tax Plan," Sept. 9, 2015

Washington Post, "Jeb Bush’s new tax plan could cost $3.4 trillion over next decade," Sept. 9, 2015

NPR, "Everything You Wanted To Know About Jeb Bush's Tax Plan," Sept. 9, 2015

Forbes, "Deconstructing The Jeb Bush Tax Plan," Sept. 9, 2015

Five Thirty Eight, "Jeb Bush’s Tax Plan Is Pretty Weird," Sept. 9, 2015

New York Times, "Jeb Bush’s Tax Plan Is a Large Tax Cut for the Wealthiest," Sept. 9, 2015

Washington Post Wonkblog, "What’s new and what isn’t in Jeb Bush’s tax plan," Sept. 9, 2015

JebBush2016.com, "Backgrounder: Jeb Bush’s Tax Reform Plan: The Reform and Growth Act of 2017," Sept. 9, 2015

Wall Street Journal, "Jeb Bush’s Tax Cuts," Sept. 9, 2015

Center for Global Enterprise, "An Assessment of Governor Jeb Bush’s ‘Reform and Growth Act of 2017’," Sept. 9, 2015

Washington Post, "Jeb Bush’s tax plan is great for Jeb Bush," Sept. 10, 2015

Cato Institute, "The Skinny on Jeb Bush’s Tax Plan," Sept. 10, 2015

Tax Foundation, "Details and Analysis of Governor Jeb Bush’s Tax Plan," Sept. 10, 2015

Citizens for Tax Justice, "More Than Half of Jeb Bush's Tax Cuts Would Go To the Top 1%," Sept. 11, 2015

Huffington Post, "More Than Half Of Jeb Bush's Proposed Tax Cuts Would Benefit The Top 1 Percent: Report," Sept. 15, 2015

Fortune, "Jeb's tax plan for private equity is a lot like Obama's," Sept. 16, 2015

Tax Policy Center, "Despite Promises, Jeb Bush’s Tax Plan Wouldn’t Eliminate Marriage Penalties," Sept. 16, 2015

Brookings Institution, "Jeb Bush's misleading tax plan," Sept. 16, 2015

Wall Street Journal, "How Would Jeb Bush’s Tax Plan Affect You?," Sept. 18, 2015

Fortune, "Why the wealthiest 1% are going to love Jeb Bush's tax proposal," Sept. 27, 2015

USA Today, "Jeb Bush: My tax proposal would deliver $2,000 to middle-class families," Sept. 28, 2015

Tax Foundation, "Comparing the 2016 Presidential Tax Reform Proposals," accessed Nov. 3, 2015

Tax Policy Center, "Major candidate tax proposals," accessed Nov. 3, 2015

Interview with Roberton Williams, Tax Policy Center Sol Price Fellow, Nov. 2, 2015

Interview with Vanessa Williamson, Brookings Institution governance studies fellow, Nov 2 & 4, 2015

Interview with Allie Brandenburger, Bush spokeswoman, Nov. 3, 2015

Interview with Kyle Pomerleau, Tax Foundation director of federal projects, Nov. 2-3, 2015

Interview with Jenice Robinson, Center for Tax Justice communications director, Nov. 2-4, 2015

Browse the Truth-O-Meter

More by Joshua Gillin

Jeb Bush says the middle class gets the biggest tax break under his plan

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.