Stand up for the facts!

Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

I would like to contribute

Sen. Kirsten Gillibrand claimed the Republican tax plan will raise middle class taxes. (Robert Kirkham/Buffalo News)

Will the Republican tax law raise middle-class taxes?

Sen. Kirsten Gillibrand claims the major tax overhaul passed by Congress this week will increase tax bills for middle-class earners in New York state.

Gillibrand, in Buffalo on Dec 15, said filers who pay state and local taxes in New York state will be hit particularly hard by the legislation.

"I'm concerned, obviously, about this tax bill because it's going to raise taxes on the middle class," Gillibrand said. "The truth is this tax [plan] raises middle-class taxes. For all New Yorkers who pay local and state taxes, it’s going to be very difficult, because they’re going to have to pay a lot more money."

Gillibrand made the claim before Republicans released their final tax bill, a compromise between versions passed in the House and Senate. We’re basing our fact check on details that were available at the time.

Was she right that middle-class earners will see higher taxes under the Republican plan?

Other tax benefits

Research groups across the political spectrum agree that the middle class will benefit from provisions in the tax law -- at least at first.

The standard deduction will double to $12,000 for single filers and $24,000 for married filers. That change was also in the Senate bill. More filers will come out ahead using the standard deduction instead of itemizing state and local taxes.

A majority of middle-income filers already take the standard deduction instead of itemizing. About 44 percent of those making between $50,000 and $75,000 deduct state and local taxes in New York state according to the Tax Policy Center.

Even in states like New York, where a third of taxpayers deduct their state and local taxes from their federal tax, the new limits on those deductions are not likely to result in higher overall tax bills.

Tax rates for middle-income earners will go down. Those making between about $38,000 and $70,000 will see their federal tax rate decrease from 25 percent to 22 percent, for example.

Middle-income filers will also benefit from a provision to double the child tax credit to $2,000. For those who owe little or no taxes, up to $1,400 of that credit is refundable.

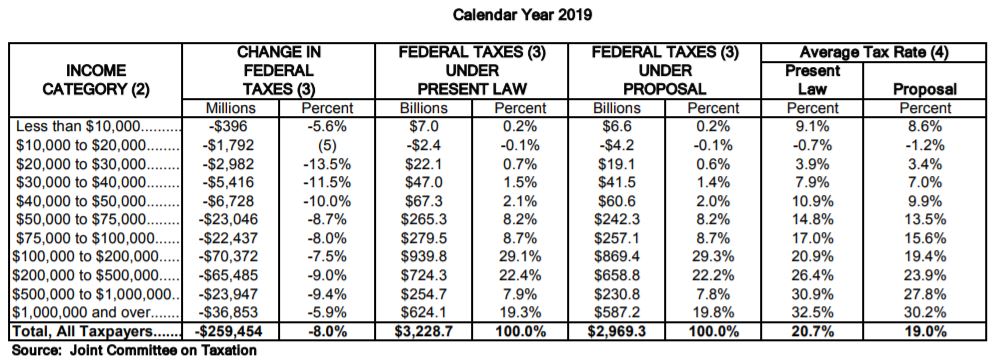

"The good news for taxpayers is that every income group would pay less in taxes in 2019," according to a PolitiFact analysis.

The analysis was based on data from the Joint Committee on Taxation, the nonpartisan group that analyzes tax bills for Congress, and the Urban Institute-Brookings Institution Tax Policy Center, an independent group that models the effects of tax legislation.

Down the road

The Joint Committee on Taxation predicted that taxpayers making $40,000 and up would see a tax cut immediately until 2025 under the law.

In 2019, filers at every income level will see a tax cut. The average person making $45,000 would see the amount of their income spent on federal taxes decrease from 10.9 percent to 9.9 percent, according to the committee's report.

The tax benefit shifts after 2025 when most changes for individual filers expire, including the lower tax brackets and cap on state and local tax deductions. After the individual provisions expire, all filers who make $75,000 or less annually will see a tax increase.

"Only those income ranges above $75,000 still see a cut by 2027," according to the PolitiFact analysis. "That’s a significantly different pattern than in 2019, when every group saves, on average."

Republicans hope a future Congress will extend the individual provisions. Experts believe that’s likely, though it’s not guaranteed.

Our ruling

Gillibrand said the Republican "tax [plan] raises middle-class taxes."

That's not true during the first years of the new tax provisions. If not for the sunset for the tax changes for individuals, we likely would have rated Gillibrand's statement False or perhaps Mostly False. Middle-income taxpayers will either benefit or see no change in their tax liability through 2025.

But her claim could hold up after the bill's individual provisions expire that year. There's no guarantee a future Congress will extend those parts of the bill.

So for that reason, her statement is partially true but still ignores important details. We rate it Half True.

Our Sources

Email and phone conversation with Glen Caplin, spokesperson for Gillibrand

"Three questions with Sen. Kirsten Gillibrand in Cheektowaga," The Buffalo News, Dec. 15, 2017

Email interview with E.J. McMahon, research director and the Empire Center for Public Policy

Phone interview with Jared Walczak, senior policy analyst at the Tax Foundation

Phone interview with Howard Gleckman, senior fellow at the Tax Policy Center

"State and Local Tax Deduction by State and AGI" Tax Policy Center

"State and Local Real Estate Tax Deduction By State and AGI" Tax Policy Center

"State and Local Income Tax Deduction By State and AGI" Tax Policy Center

"Here's what's in the Senate Republican tax bill", CNN, Nov. 30, 2017

"What's in the GOP's final tax plan", CNN, Dec. 17, 2017

"The State and Local Tax Deduction: A Primer" Tax Foundation

"State Individual Income Tax Rates and Brackets for 2017" Tax Foundation

PolitiFact: NC Sen. Tillis says plan won't raise taxes on Americans earning $30K-$70K a year, Nov. 30, 2017

"Which Places Pay the Most in Property Taxes?" Tax Foundation

"Distributional Analysis of the Conference Agreement for the Tax Cuts and Jobs Act", Tax Policy Center, Dec. 18, 2017

CBO report on removing the individual mandate

"JCT Estimates: Final GOP Tax Bill Skewed to Top, Hurts Many Low- and Middle-Income Americans", Center on Budget and Policy Priorities, Dec. 19, 2017

PolitiFact Wisconsin: House tax plan: Permanent tax cuts for the rich, eventually tax hikes for all middle-class families?, Dec. 15, 2017

PolitiFact: Who wins and who loses from the tax bill?, Dec. 19, 2017

Browse the Truth-O-Meter

More by Dan Clark

Will the Republican tax law raise middle-class taxes?

Support independent fact-checking.

Become a member!

In a world of wild talk and fake news, help us stand up for the facts.

PolitiFact Rating:

PolitiFact Rating: