As a presidential candidate, Donald Trump pledged to provide relief to married couples hurt by the tax code.

On Dec. 19 and 20, the Senate and the House passed the final version of the tax bill, which will go to the president for his signature.

So how did this bill treat the marriage penalty? It didn't eliminate it entirely, but it did lessen its reach.

Promise: The tax bill "eliminates the marriage penalty"

A "marriage penalty" occurs when two individuals end up paying more when they are married then they would have if they had both been single. This quirk stems from having different tax brackets for individual filers and married couples.

There is no marriage penalty if the individual income cutoffs for a given tax rate are twice as high for a married couple. A marriage penalty comes into play when the cutoffs for a married couple are less than twice the individual cutoff.

Prior to passage of the bill, for instance, the two lowest tax brackets -- 10 percent and 15 percent tax brackets -- do not face any penalty. That covers incomes up to $37,950. The penalty starts to phase in for those in the 25 percent tax bracket, which covers those earning between $37,950 and $91,900 (individuals) or $75,900 and $153,000 (married couples).

Above that, every tax bracket has a marriage penalty under current law. Here are the tax brackets prior to passage of the new bill:

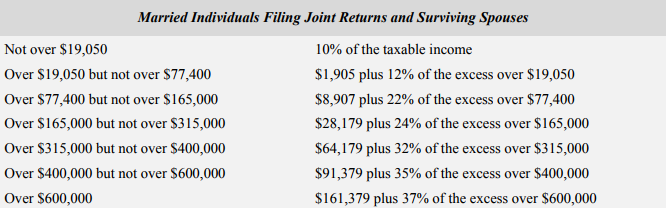

The new bill eases that situation. Under the new brackets, the marriage penalty only phases in with the second-highest tax bracket -- the 35 percent bracket, which is for earners between $200,000 and $500,000 (individual) and $400,000 and $600,000 (married couples).

Here are the new brackets:

In other words, while the tax bill didn't eliminate the marriage penalty, many fewer taxpayers would face it for regular taxable income.

Meanwhile, there are other, less obvious marriage penalties, and the bill addresses some of those as well, said Joseph Rosenberg, senior research associate at the Urban Institute-Brookings Institution Tax Policy Center.

For instance, Rosenberg said, under prior law, the child credit was phased out at $75,000 for individuals and $110 for married couples. Under the new bill, the cutoffs are at $200,000 and $400,000.

The tax bill has gone a long way toward curbing the marriage penalty, but it didn't eliminate it, as Trump had pledged. We rate it a Compromise.