Our only agenda is to publish the truth so you can be an informed participant in democracy.

We need your help.

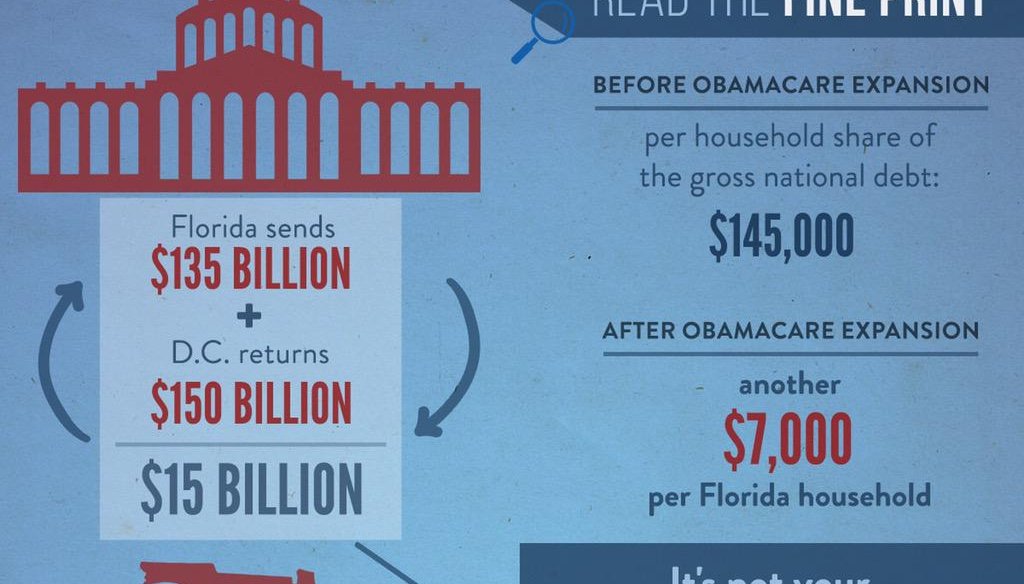

House members have been tweeting this infographic to argue Florida should not accept Medicaid expansion money from Washington. (Photo via Twitter)

Florida House members left the 2015 legislative session early over health care funding, but they’ve kept on railing against Medicaid expansion while waiting to reconvene to discuss a state budget.

Rep. Debbie Mayfield, R-Vero Beach, argued against taking federal money to expand Medicaid, the joint state-federal health insurance program for the very poor, saying it wasn’t Florida’s money to take.

"FL is NOT a donor state. Get the facts on federal spending and Medicaid expansion in FL," she tweeted. The tweet included an infographic that read, "Florida sends $135 billion and D.C. returns $150 billion. It's not your hard-earned tax dollars! It's borrowed against your children’s future!"

Other House Republicans shared the same infographic, including Speaker Steve Crisafulli, R-Merritt Island. We wondered where they were getting their numbers.

Tax totals

House communications director Michael Williams said the amount Florida sends comes from Internal Revenue Service gross tax collections in the state ($154 billion in 2014) minus average tax refunds, ending up at $135 billion.

The amount Washington sent back came from USASpending.gov, a website that tracks federal contracts, loans, grants and public assistance. The site says the federal government spent $150 billion in Florida in fiscal year 2014.

Subtract $135 billion from $150 billion, and that accounts for Florida getting $15 billion more than it puts in.

But tax policy experts told us there are different ways to calculate the numbers, so it’s not as cut and dried as the House makes it out to be.

Steve Ellis, vice president of watchdog group Taxpayers for Common Sense, said the House’s methodology is generally sound, but he would suggest using actual tax refunds instead of average refunds. He said that would push Florida’s payout total even lower than $135 billion.

On the spending side, National Priorities Project research director Lindsay Koshgarian points out that data from USASpending.gov does not give the most reliable picture available. Koshgarian said that among the site’s issues is that it does not include all grants or federal employees and operations in state spending totals. She suggested using data from the Bureau of Economic Analysis and Census Bureau would yield a more accurate total.

So federal tax totals paid out of Florida may be lower than what the House is saying, while federal spending could be even higher. But our experts said that comparison still doesn’t paint a good picture of the state’s nuances.

For example, Social Security and Medicare costs are disproportionately high in Florida because of the retiree population, which already paid into the system, but likely in another state. Florida has the third-largest uninsured pool in the country, with a public assistance budget to match. Also, there’s a lot of that $150 billion in Washington cash that isn’t as controversial in the House as Medicaid spending, like money for infrastructure or federal contracts for businesses like Lockheed Martin and Raytheon.

"I doubt these folks are saying the state should not be taking federal highway money, just because they are taking in more than they spend," said Paul Van De Water, a senior fellow with the left-leaning Center for Budget and Policy Priorities.

Differences between states make it difficult to make direct comparisons, Koshgarian said. She cited the Centers for Disease Control and Prevention in Atlanta to illustrate her point. "We all need one CDC, but we don't need one in every state, so the dollars have to go somewhere," she said.

Koshgarian said that in 2013, the last year with complete Census data, Florida received the fourth-highest total of federal grants to state government with $23.5 billion (the bulk of which was Medicaid), but was 48th among states for federal grant dollars per resident -- only Nevada and Virginia ranked lower. Those numbers mostly reflect Florida’s status as one of the more populous states.

Ellis added that there’s one other thing to keep in mind to put Mayfield’s point in context: The U.S. government is always in the red these days.

"In my opinion, no state is a donor state when you consider that the budget deficit is nearly half a trillion dollars, so no one is paying their way," he said.

Our ruling

Mayfield said, "Florida sends $135 billion and D.C. returns $150 billion."

Tax policy experts told us the House’s numbers were one way to look at it, but different data sources could yield different totals. They also said such a comparison really doesn’t illustrate the nuances of what federal money is used for in Florida or why. We rate the statement Mostly True.

Twitter, State Rep. Debbie Mayfield’s account, May 4, 2015

Gainesville Sun, "Florida pays more in federal taxes than it gets back in grants," Oct. 15, 2012

Center on Budget and Policy Priorities, "Where Do Federal Tax Revenues Come From?," March 11, 2015

Internal Revenue Service, "SOI Tax Stats - Collections and Refunds, by Type of Tax - IRS Data Book Table 1," accessed May 6, 2015

Internal Revenue Service, "SOI Tax Stats - Gross Collections, by Type of Tax and State, Fiscal Year - IRS Data Book Table 5," accessed May 6, 2015

Internal Revenue Service, "SOI Tax Stats - Amount of Refunds Issued, Including Interest, by State and Fiscal Year - IRS Data Book Table 8," accessed May 6, 2015

National Priorities Project, "State Smart: Federal Funds in Florida," accessed May 6, 2015

USASpending.gov, "State Summary: Florida," accessed May 6, 2015

U.S. Bureau of Economic Analysis, "Annual State Personal Income and Employment," accessed May 7, 2015

U.S. Census Bureau, "State Government Finances," accessed May 7, 2015

Interview with Michael Williams, Florida House communications director, May 6, 2015

Interview with Paul Van de Water, Center for Budget and Policy Priorities senior fellow, May 6, 2015

Interview with National Priorities Project research director Lindsay Koshgarian, May 6-7, 2015

Interview with Steve Ellis, Taxpayers for Common Sense vice president, May 6-7, 2015

In a world of wild talk and fake news, help us stand up for the facts.